Film about the BCL's missions and tasks

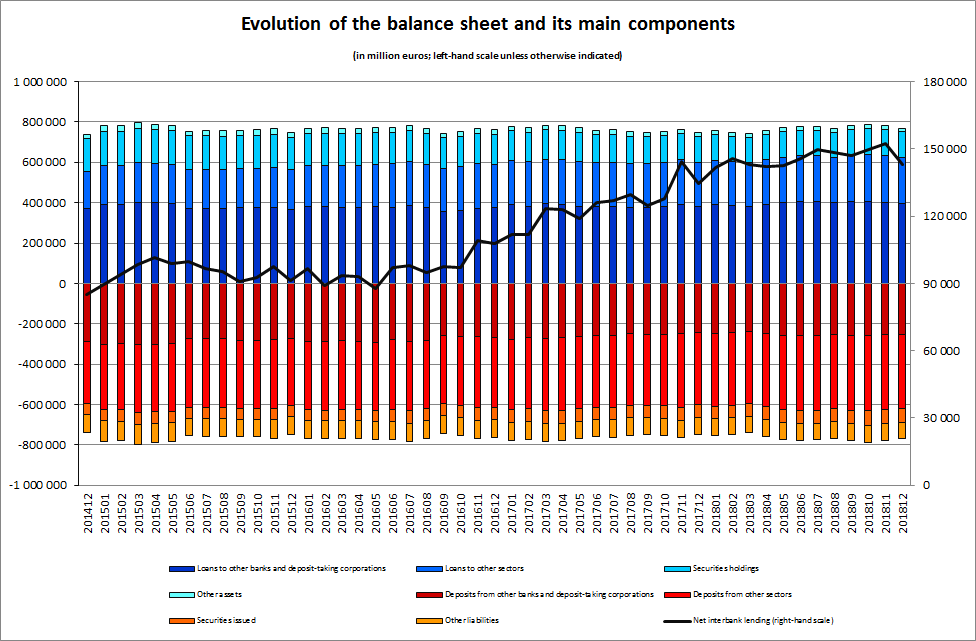

Evolution of credit institutions’ balance sheet

The Banque centrale du Luxembourg (BCL) informs that, based on preliminary data, the aggregated balance sheet of credit institutions reached 768 692 million euros on 31 December 2018, compared to 780 338 million euros on 30 November 2018, a decrease of 1.5%. Between the months of December 2017 and December 2018, the aggregated balance sheet increased by 3.0%.

Net interbank lending, that is to say the difference between interbank loans and deposits, reached 143 249 million euros at the end of December 2018.

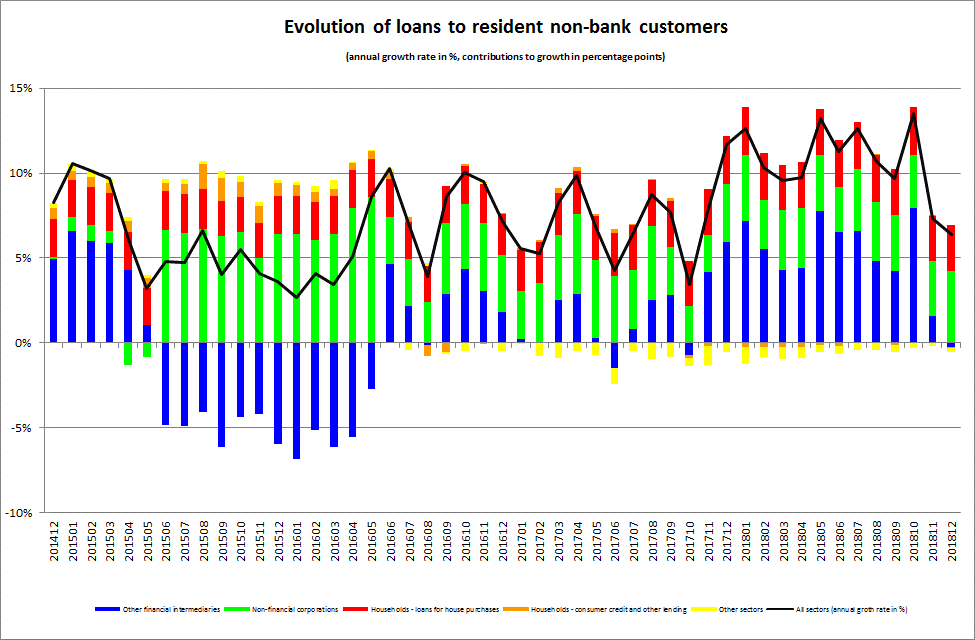

Loans to resident non-bank customers decreased by 551 million euros, or 0.6%, between November 2018 and December 2018. Between December 2017 and December 2018, these loans increased by 5 496 million euros (6.4%).

The progression of loans to resident non-bank customers was largely attributable to two out of three main components. Indeed, between December 2017 and December 2018, loans to non-financial corporations (NFCs) rose by 3 614 million euros (15.2%) and loans for house purchases by 2 359 million euros (8.4%), while loans to other financial intermediaries (OFIs) decreased slightly (by 231 million euros, or 0.9%).

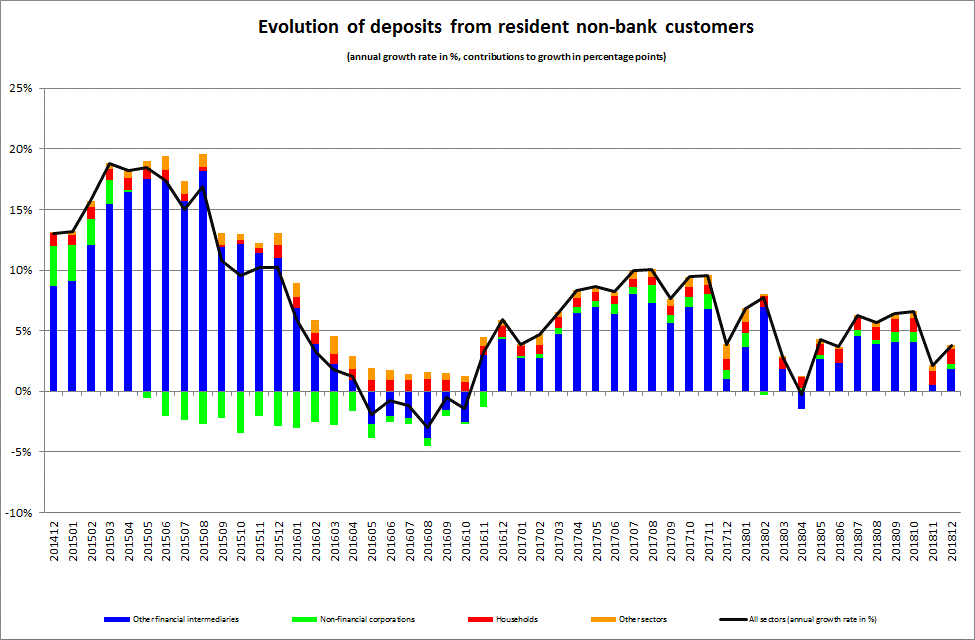

With regard to the liability side, deposits from the resident non-bank sector decreased by 11 081 million euros (4.4%) between 30 November 2018 and 31 December 2018. On an annual basis, these deposits increased by 8 713 million euros, or 3.8%.

Between December 2017 and December 2018, the increase in deposits from the resident non-banking sector was largely attributable to its main component, that is to say deposits from the OFI sector, which had a share of 68.2% as at 31 December 2018 and comprised deposits made by monetary and non-monetary investment funds. Indeed, over the last twelve months, resident OFI deposits increased by 4 151 million euros, or 2.6%. With regard to other sectors, resident household deposits increased by 2 862 million euros (7.9%), while resident NFC deposits increased by 977 million euros (6.0%).

The tables pertaining to the balance sheet of credit institutions can be consulted on the BCL’s website on the following page:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/11_credit_institutions/index.html