Film about the BCL's missions and tasks

Balance of payments of Luxembourg for the first half of 2020

The Banque centrale du Luxembourg (BCL) and STATEC inform that the balance of payments figures, published on September 21st, have been part of a benchmark revision (which normally takes place every 5 years). The new data from 2002 onwards include not only many updates and corrections, but also some methodological changes. For the years prior to 2012, the revisions mainly concerned the current account. They resulted in a significant drop in its balance, while strongly affecting its sub-components. However, these changes were necessary, not only to eliminate breaks in series, but also to improve consistency with other statistics and to reflect the treatment of certain globalisation phenomena from the start of the compilation of the current account, including in particular:

- the estimate of special purpose entities (former holding-type companies) by the sum of the costs incurred in Luxembourg;

- the recording of "toll manufacturing" (resident entities coordinating the production process abroad, remaining owners of goods throughout the chain) under "general merchandise" (for the purchase of raw materials and sale of finished products) and under manufacturing services (for the production cost, including labor abroad).

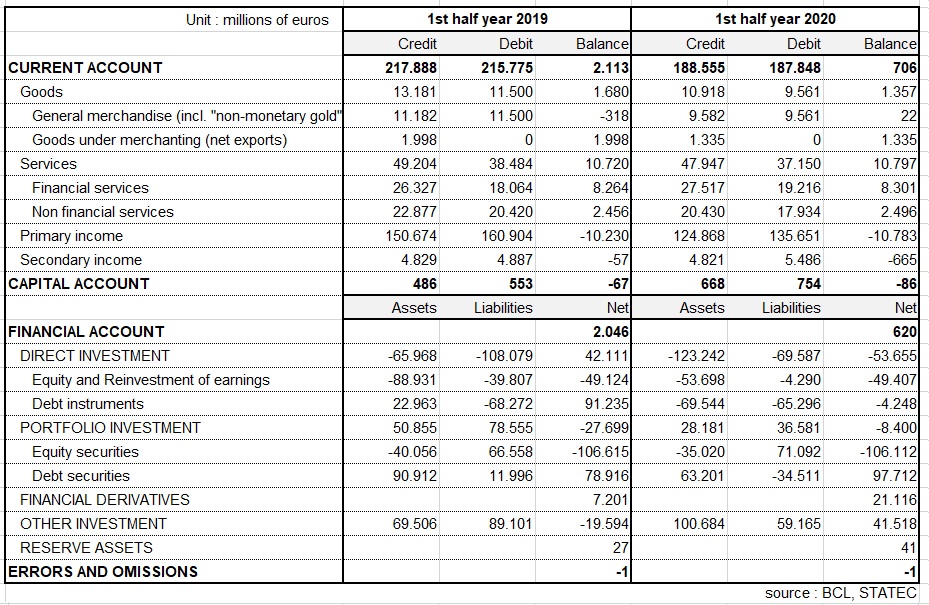

The current account balance for the first half of 2020 amounts to 706 million euros, a decrease of 1.4 billion compared to the same period of 2019. The balance of goods as well as those of primary and secondary income fell. The fall of the latter is mainly due to an increase in social contributions paid to cross-border workers during confinement (partial unemployment, extraordinary leave for family reasons, etc.). However, the health crisis has had repercussions on all components of the current account, even if some are not visible at first glance.

Concerning goods, exports and imports showed a drop of around 17% in the first half of 2020, the decline having affected all types of products, the low point being in April. As regards international trade in services, the situation is different. Financial services performed relatively well (with + 4.5% and + 6.4% respectively for exports and imports, compared to the first half of 2019). Indeed, the financial sector has been less impacted by the health crisis than the rest of the economy. After two consecutive months of decline in February and March, net assets under management of investment funds (which have the most significant impact on financial services) have since returned to growth (+4% in the first half of 2020). On the other hand, non-financial services suffered a significant decline for both exports (-10.7%) and imports (-12.2%). The services most affected by this development are travel services (especially with the collapse of business travel), other business services, as well as personal, cultural and recreational services.

In the financial account, in the first half of 2020, direct investment flows were still characterized by disinvestment operations for both assets (-123 billion euros) and liabilities (-69 billion euros). These operations concerned a small number of SOPARFIs that continued restructuring, ceasing or relocating their activities.

Regarding portfolio investments, the second quarter of 2020 was characterized by the resumption of investments in Luxembourg equities (largely Investments Funds shares), after the net sales observed in the first quarter of 2020, in a context of falling stock prices following the Covid-19 pandemic. Transactions in Luxembourg equity shares thus resulted in net inflows of 71 billion euros in the first half of 2020. Luxembourg debt securities, however, suffered net sales of 34 billion euros in the first half of 2020.

Luxembourg residents continued turning away from foreign equity securities, which have suffered net sales of 35 billion euros in the first half of 2020. On the other hand, foreign debt securities experienced net purchases of 63 billion euros over the same period.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg