Film about the BCL's missions and tasks

Balance des paiements du Luxembourg au premier semestre 2017

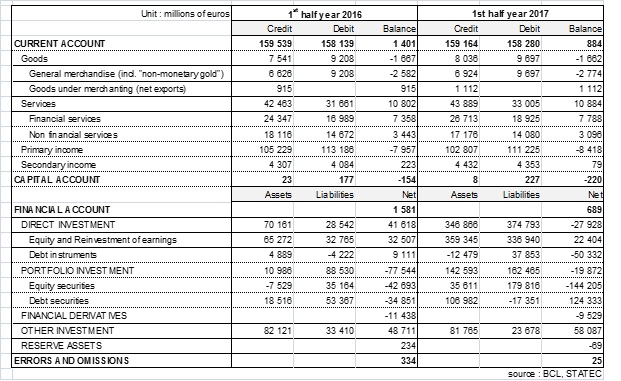

The Central Bank of Luxembourg (BCL) and STATEC inform that, according to preliminary provisional results, the current account for the first half-year of 2017 showed a surplus of 884 million euros, compared to 1.4 billion for the same period of the previous year.

During the first six months of the year, goods transactions (on a balance of payments basis: transfer of ownership between residents and non-residents with or without border crossing) resulted in a deficit of 1.7 billion euros, remaining stable compared to the first half of 2016. In fact, net exports of merchanting (up by about 200 million euros) offset the growing of the general merchandise deficit, due in particular to the acquisition of a satellite in the first quarter of 2017.

International trade in financial services continued to grow. In the first half of 2017, the surplus of financial services amounted to 7.9 billion euros, increasing by 430 million euros (5.8%) compared to the first half of 2016. This growth more than expunged the drop of 347 million euros (-10%) of the surplus of international trade in non-financial services. This phenomenon can be partly explained by the departure in September 2016 of an e-commerce company.

In the first half of 2017, primary and secondary incomes showed a decline in their respective balances, in particular as a result of the growing number of cross-border workers (increase in expenditure) and the tax reform (lower income).

In the financial account, non-residents' investments in equity securities issued by Luxembourg (mostly investments funds shares) continued increasing and reached up 170 billion euros during the first semester of 2017, compared with 35 billion euros in the first semester of 2016. On the other hand, net sales of debt securities by non-residents amounted to 17 billion euros in the first half of 2017, compared with net purchases of 53 billion in the same half of 2016. Overall, net inflows on securities issued by Luxembourg reached up 162 billion euros in the first half of 2017, compared with 88 billion euros in the same period in 2016. Net inflows on securities issued by Luxembourg thus sharply increased up to 162 billion euros in the first semester of 2017 from 88 billion in the first semester of 2016.

With regard to foreign securities, residents similarly sharply increased their investments in the first semester of 2017, which totalled 142 billion euros compared to 11 billion in the first semester of 2016. In addition, gross flows of direct investment, which had fallen sharply during the year 2016, increased substantially in the first half of 2017, mainly as a result of a restructuring of the holdings of a large multinational company.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg