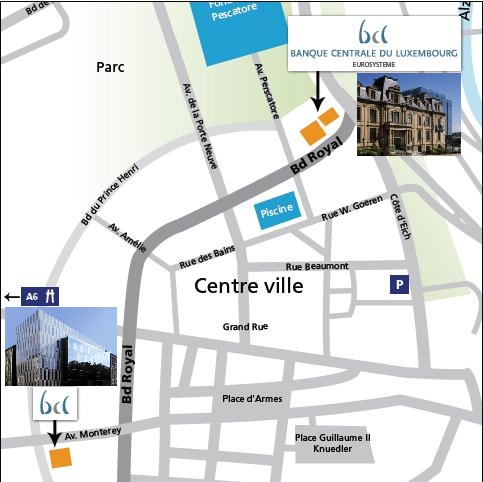

43, avenue Monterey

L-2983 Luxembourg

From Monday to Friday:

10:30 a.m. - 4:00 p.m.

If someone intends to give you a banknote, which looks like the ones below, do not accept it: it’s probably a stolen banknote!

|

|

Photos source ECB

The ink on these banknotes comes from an anti-theft device, also known as intelligent banknote neutralisation systems (IBNS). The banknote neutralisation system is triggered following an unauthorised theft or attempted to open a safe, a smart suitcase[1] or ATM. When the IBNS is activated, the security ink spreads over each banknote, leaving characteristic traces that extend from the edge of the ticket to the centre of the denomination. The colours of the most commonly used security inks are green, purple, blue, red or black. However, some criminals, when trying to remove the security ink from the banknotes, use chemicals, which can alter the original colour. This "washing" can also damage or even erase security features.

When the banknote has only a few marks and the ink stains are small, while its edges are intact, there is a good chance that the stains are accidental and were caused, for example, by a pen with leaking ink. The following notes are unlikely to have been stolen and can therefore be accepted:

|

|

|

Article 3 of the decision of the European Central Bank of 19 April 2013 on the denominations, specifications, reproduction, exchange and withdrawal of euro banknotes (ECB/2013/10) provides the framework for the exchange of damaged genuine euro banknotes by stating that “the banknotes shall be exchanged only at the request of the owner or otherwise authorised applicant who is the victim of the attempted or actual criminal activity leading to the damage to the banknotes”. In addition, Decision ECB/2013/10 stipulates that NCBs may withhold and refuse to reimburse stained banknotes if they know or have sufficient reason to believe that the banknotes originate from a criminal offence in order to hand them over to the competent national authorities for criminal investigation.

However, NCBs may exchange damaged genuine euro banknotes if they know or have sufficient reason to believe that the applicant is acting in good faith or if the applicant can prove his good faith.

More information is available on the European Central Bank website under the following links:

https://www.ecb.europa.eu/euro/banknotes/ink-stained/html/index.en.html

https://www.ecb.europa.eu/ecb/legal/pdf/l_11820130430en00370042.pdf

__________________

[1] According to a grand-ducal regulation (Règlement grand-ducal du 22 août 2003 portant exécution de certaines dispositions de la loi du 12 novembre 2002 relative aux activités privées de surveillance et de gardiennage, modified by the Règlement grand-ducal du 21 septembre 2006) the transport of cash above 20 000 € or when executed on foot on the public domain for more than 5 meters, an IBNS has to be used.