Film about the BCL's missions and tasks

Balance of payments of Luxembourg for the first half of 2019

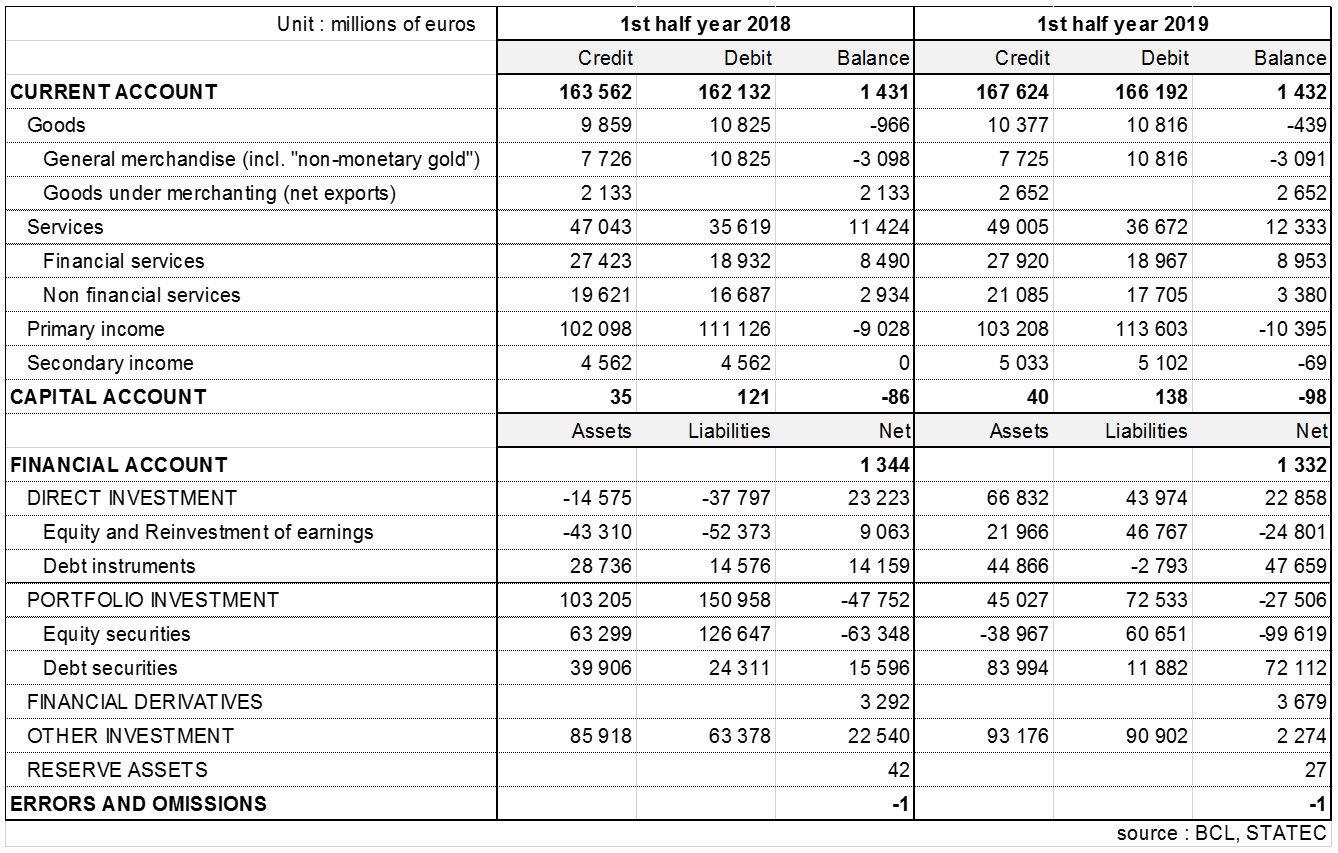

The Central Bank of Luxembourg (BCL) and STATEC inform that, according to preliminary results, the current account for the first half of 2019 showed a surplus of 1.4 billion euros, almost the same level than during the same period of the previous year. The increase in both goods and services balances offset the drop in primary and secondary income balances.

Due to a significant increase in net exports under merchanting (+ 24%), the goods deficit decreased by 527 million euros, to settle at -439 million in the first half of 2019. In Luxembourg, however, the merchanting activity remains volatile, as it is concentrated around a small number of companies belonging to large multinationals. The virtual stagnation of trade in general merchandise hides diverging developments at a more detailed level. In fact, the decline of trade under toll manufacturing agreements (purchase of raw materials and their resale in the form of finished products, after subcontracting their processing, all abroad i.e. without crossing national borders) offset, among others, the increase of exports of machinery and equipment (+8%), transport equipment (+18%) and imports of petroleum products (+6%).

Exports and imports of services increased by 4% and 3% respectively during the period under review, mainly due to non-financial services (+ 8% and + 6% respectively). Professional and management consulting services are mainly driving exports, while imports mostly increase due to charges for the use of intellectual property (royalties) and telecommunication services.

In the financial account, direct investment flows resumed in the first half of 2019, for both assets (67 billion euros) and liabilities (44 billion euros), after the divestments observed throughout 2018. Regarding portfolio investment, non-resident investments in securities issued by Luxembourg (largely Investments Funds shares) widely decreased, reaching 60 billion euros in the first half of 2019, compared to net inflows of 127 billion euros in same half of 2018. With regard to foreign securities, in the first half of 2019, residents disposed of equity securities (net sales of 39 billion euros) in favor of debt securities (net purchases of 84 billion euros). Portfolio investment flows resulted in net inflows of 27 billion euros in the first half of 2019, offset entirely by the net outflows in direct investments and in financial derivatives as well as in other investments (deposits and traditional credits).

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg