Film about the BCL's missions and tasks

Interest rates

The Banque centrale du Luxembourg (BCL) informs that, based on preliminary data, the main interest rates applied by Luxembourg’s credit institutions to euro area households and non-financial corporations (NFCs) for their loan and deposit operations have on average evolved as follows in December 2019.

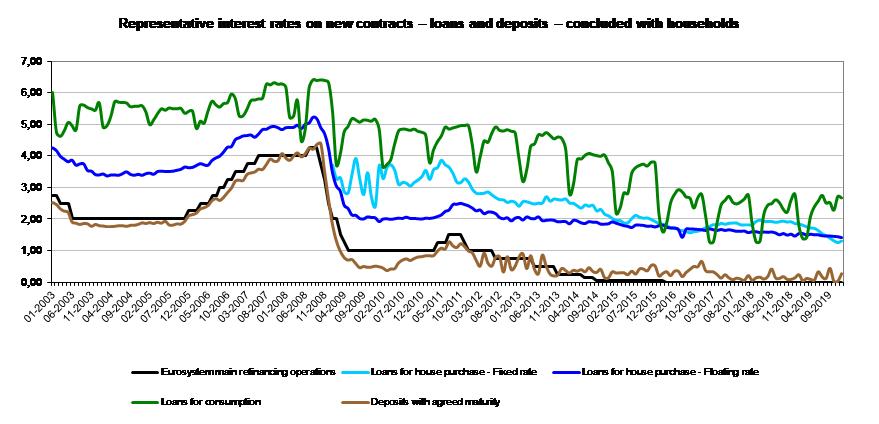

Representative interest rates on new contracts[1] – loans and deposits – concluded with households

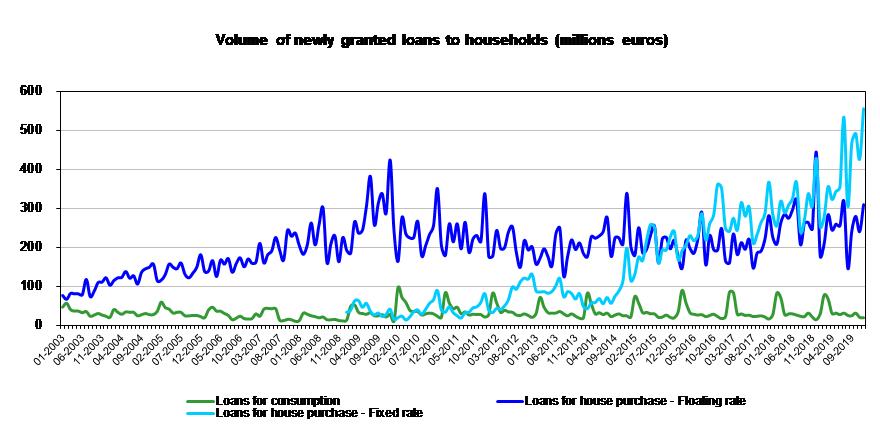

The variable[2] interest rate on mortgage loans granted to households has decreased by 3 basis points on a monthly basis to reach 1.40% in December 2019 whereas the volume of these newly granted loans has increased by 69 million euros to reach 309 million euros. On a yearly basis, the interest rate has decreased by 5 basis points and the volume of newly granted loans has decreased by 134 million euros.

The fixed[3] interest rate on mortgage loans granted to households has increased by 5 basis points on a monthly basis to reach 1.31% in December 2019. The volume of these newly granted loans has increased by 126 million euros on a monthly basis and has consequently amounted to 552 million euros during the last reference period. On a yearly basis, this interest rate has decreased by 55 basis points whereas the volume of newly granted loans has increased by 124 million euros.

The interest rate on consumer loans that have an initial fixation period above 1 year and below or equal to 5 years has decreased by 4 basis points on a monthly basis to reach 2.68% in December 2019 whereas the volume of newly granted loans has decreased by 1 million euros to reach 20 million euros. On a yearly basis, the interest rate has decreased by 11 basis points whereas the volume of new lending has increased by 5 million euros.

The interest rate on households’ fixed-term deposits that have an initial maturity below or equal to 1 year has increased by 24 basis points on a monthly basis to reach 26 basis points in December 2019.

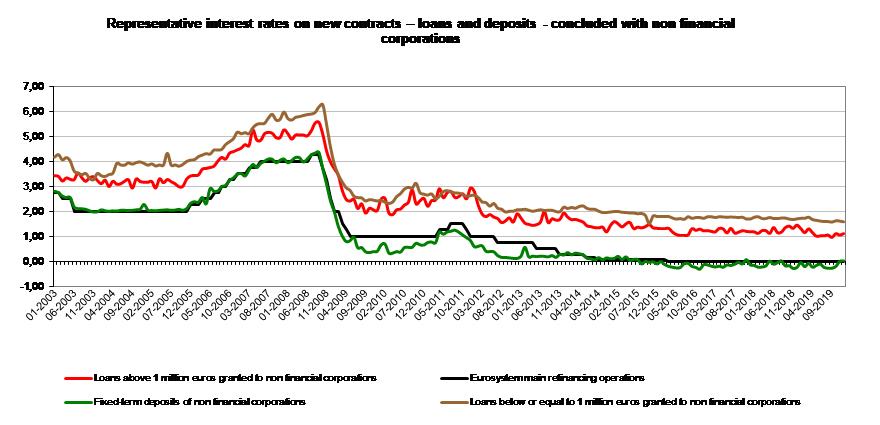

Representative interest rates on new contracts2 – loans and deposits – concluded with NFCs

The variable3 interest rate on loans below or equal to 1 million euros granted to NFCs has decreased by 3 basis points on a monthly basis to reach 1.59% in December 2019. The volume of newly granted loans has increased by 35 million euros on a monthly basis, reaching 787 million euros in December 2019. On a yearly basis, this interest rate has decreased by 12 basis points and the volume of newly granted loans has decreased by 184 million euros.

The variable3 interest rate on loans above 1 million euros granted to NFCs has increased by 6 basis points on a monthly basis to reach 1.11% during the last reference period, whereas the new business volume has increased by 679 million euros to reach 5 288 million euros. On a yearly basis, this interest rate has decreased by 34 basis points and the volume of newly granted loans has decreased by 2 932 million euros.

The interest rate on fixed-term deposits of NFCs with an initial maturity below or equal to 1 year has reached 2 basis points in December 2019 from 0 basis points in November 2019. On a yearly basis, this interest rate has increased by 26 basis points.

The tables pertaining to interest rates applied to credit institutions can be consulted and/or downloaded on the BCL’s website on the following pages:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/03_Capital_markets/index.html

Weighting method

The interest rates applied to new contracts are weighted within the categories of instruments concerned by the amounts of individual contracts. This results from the compilation of national aggregates carried out by reporting credit institutions and by the BCL.

[1] New contracts refer to any new agreement concluded between the household or the non-financial corporation and the reporting agent. New contracts include all financial contracts which mention for the first time the interest rate pertaining to the deposit or credit and all renegotiations of existing deposits or credits.

[2] Variable interest rate or rate with an initial fixation period inferior or equal to 1 year.

[3] Fixed interest rate weighted by the amounts of contracts for all mortgage loans granted, whatever the initial rate fixation period (above 1 year). This series has been published by the BCL since February 2009 only for methodological reasons linked to the identification of reporting agents.