Film about the BCL's missions and tasks

Balance of payments of Luxembourg during the first quarter of 2020

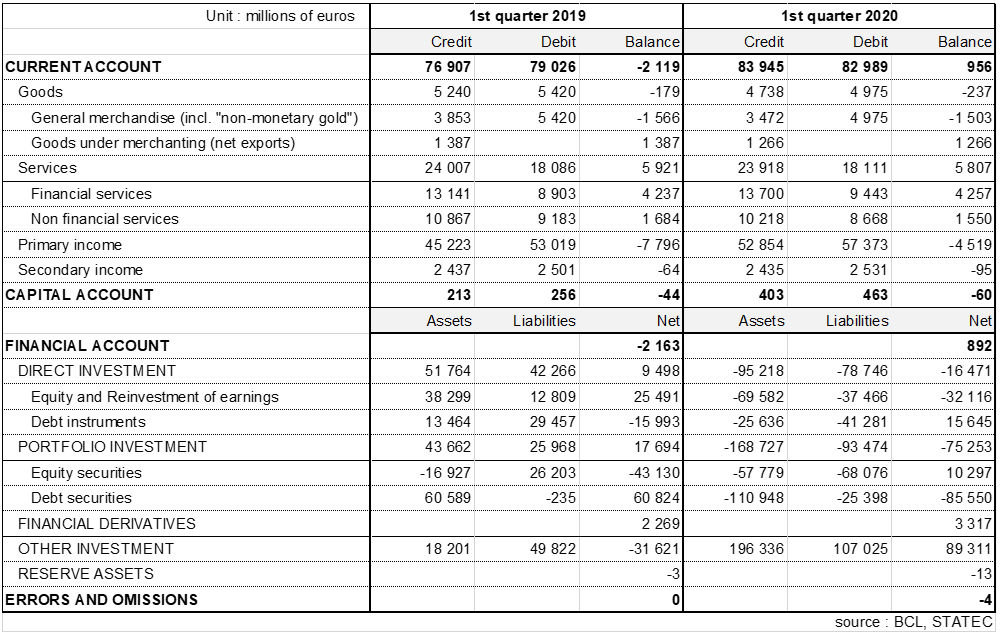

The Central Bank of Luxembourg (BCL) and STATEC inform that according to the first provisional results, the current account shows a surplus of 956 million euros for the first quarter of 2020, an increase of more than 3 billion compared to the same period of the previous year. This change is mainly explained by investment income, which can strongly fluctuate from one quarter to another.

The goods deficit stood at -237 million euros and only slightly widened in the first quarter of 2020 (-58 million). In terms of exports and imports of goods however, there have been significant decreases. First, net exports of merchanting (purchases and sales of goods without passing through Luxembourg) fell by almost 9% (-121 million euros). For general merchandise (i.e. excluding merchanting), the decrease of exports is close to 10% (-381 million euros) and mainly concerns manufactured products, machinery and equipment. As for imports, which declined by 8.2% (-445 million euros), almost all products were affected. Imports were more impacted than exports mainly due to petroleum products, for which the fall in prices added to the one in volumes.

The balance of international trade in services fell by almost 2% in the first quarter of 2020 (-114 million euros), while exports and imports varied only very slightly (with -0.4 and 0.1% respectively). At the sublevel however, the developments were more contrasted. Trade in non-financial services fell sharply, both for exports (-6%) and imports (-5.6%). Personal, cultural and recreational services, other business services and charges for the use of intellectual property were declining in particular. On the other hand, international trade in financial services increased sharply, with +4.3% for exports and +6% for imports. This evolution is explained by the significant appreciation of average net assets managed by investment funds during the period under review (+6.2%), despite the sharp drop in March 2020 due to the turmoil on financial markets, related to the health crisis.

In the financial account, in the first quarter of 2020, direct investment flows were still characterized by disinvestment operations for both assets (-95 billion euros) and liabilities (-79 billion euros). These operations concerned a small number of SOPARFIs that continued restructuring, ceasing or relocating their activities.

Regarding portfolio investments, in a context of declining stock prices following the Covid-19 pandemic, non-residents have turned away from Luxembourg equities securities (largely Investments Funds shares), which have suffered net sales of 68 billion euros in the first quarter of 2020. Luxembourg debt securities also experienced net sales of 25 billion euros in the first quarter of 2020. With regard to foreign securities, in the first quarter of 2020, Luxembourg residents disposed of equity securities (net sales of 58 billion euros) as well as debt securities (net sales of 111 billion euros). Portfolio investment flows thus resulted in net capital inflows of 75 billion euros in the first quarter of 2020.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg