- European Central Bank publications

18/ The April 2022 ECB Governing Council monetary policy decisions: Incoming data reinforcing expectations of monetary policy normalisation

29/04/2022

Blog post by Gaston Reinesch, Governor of the BCL

In December 2021 the Governing Council assessed that the progress on economic recovery and towards its medium-term inflation target permitted a step-by-step reduction in the pace of its net asset purchases and decided to discontinue net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) at the end of March 2022.

The Governing Council recalibrated its monetary policy statement on 3 February 2022, prior to the Russian invasion of Ukraine, acknowledging that inflation had further surprised to the upside in January 2022 and was likely to remain elevated for longer than previously expected. The Governing Council also pointed out that “compared with our expectations in December, risks to the inflation outlook are tilted to the upside, particularly in the near term” and emphasised the need to maintain flexibility and optionality.[1]

In March 2022, the Governing Council reassessed the euro area inflation outlook in the context of Russia’s aggression towards Ukraine and the March 2022 ECB staff macroeconomic projections. [2] Based on its updated assessment, the Governing Council revised the net purchase schedule for the Asset Purchase programme (APP) to €40 billion in April 2022, €30 billion in May 2022 and €20 billion in June 2022.[3]

The Governing Council also indicated a possible conclusion of net asset purchases under the APP in 2022Q3, conditional on incoming data continuing to support the expectation that the medium-term inflation outlook would not weaken and without prejudice to the very elevated uncertainty. Reflecting the high uncertainty, the Governing Council pointed out that it stands ready to revise the schedule for net asset purchases in terms of size and/or duration if the medium-term inflation outlook changed and if financing conditions became inconsistent with further progress towards the 2% target.

Furthermore, the Governing Council complemented the (conditional) end date for net APP asset purchases by announcing that any gradual and data-dependent adjustments to the key ECB interest rates would take place “some time after” the end of net asset purchases.[4] The expression “some time after” caters for the flexibility/optionality needed as to the length of the period between an end of net asset purchases and a first rate hike.[5]

On 14 April 2022, the Governing Council updated its assessment of the inflation outlook taking into account the very elevated uncertainty now and in the period ahead. It judged that incoming data since the March Governing Council meeting reinforced its expectation that net asset purchases under the APP should be concluded in the third quarter of 2022.

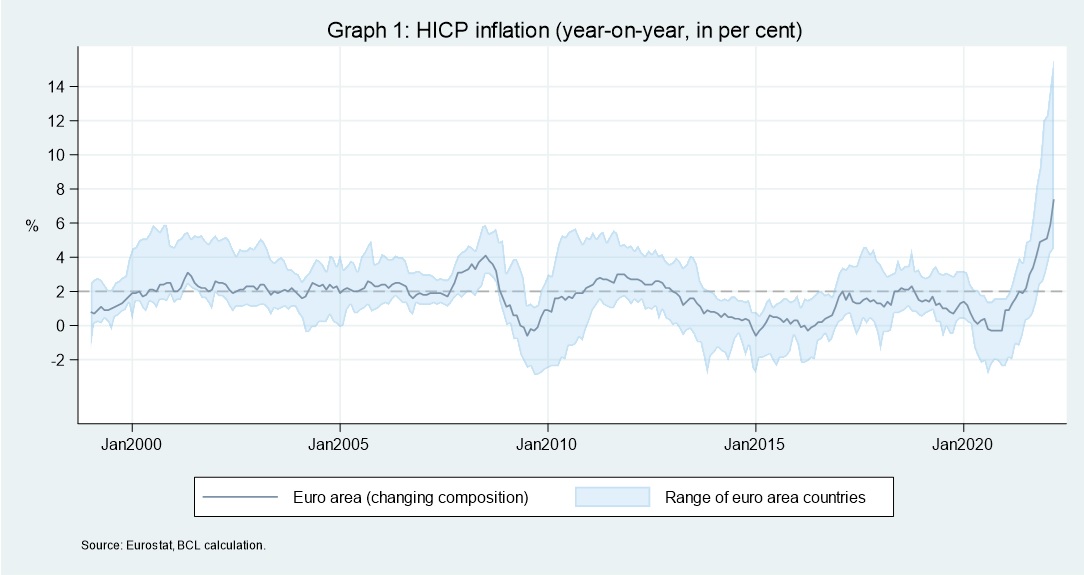

From November 2021 (the most recent inflation record at the time of the December 2021 Governing Council decisions) to February 2022 (the most recent data at the time of the March Governing Council meeting), for instance, euro area HICP inflation (i.e. the annual rate of change of the index relative to the same month of the previous year) had increased from 4.9 per cent to 5.8 per cent.[6]

By the 14 April 2022 Governing Council meeting, the latest Eurostat HICP Flash estimate for March 2022 had reported a further increase in euro area inflation to 7.5 per cent (see Graph 1 below).[7] Between November 2021 and March 2022, inflation rates increased in all euro area countries.

Price pressures are particularly strong for HICP energy items (with prices rising year-on-year by 44.4 per cent in March 2022, up from 27.5 per cent in November 2021 and up from 32.0 per cent in February 2022). In March 2022, energy items contributed almost 4.4 percentage points to HICP inflation.

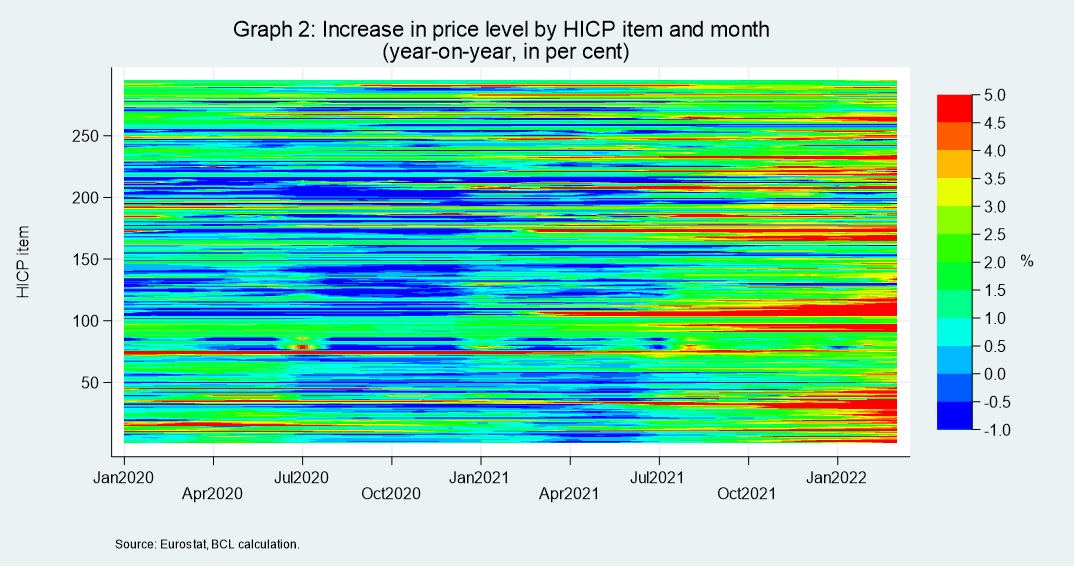

But given that energy costs feed through to prices in many sectors, price pressures have become more widespread across HICP items (see Graph 2 below). The HICP inflation rate excluding energy items stood at 2.5 per cent in November 2021, increased to 3.1 per cent in February 2022 and to 3.4 per cent in March 2022. Food prices, for instance, increased by 5.0 per cent year-on-year in March 2022, up from 2.2 per cent in November 2021 and 4.2 per cent in February 2022, reflecting rising production and transportation costs.

As the euro area economy recovered from the COVID-19 pandemic, and owing to shortages of material and inputs as well as trade disruptions, demand resumed more quickly than supply, an imbalance contributing to rising price pressures. Prices of non-energy industrial goods increased by 3.4 per cent year-on-year in March 2022 (up from 2.4 per cent in November 2021 and 3.1 per cent in February 2022).

In November 2021, the share of euro area HICP items with a year-on-year increase in prices above two per cent (i.e. the symmetric inflation target level over the medium term for headline HICP) had stood at 52 per cent. By February 2022, that share had increased to 66 per cent. In March 2022, the share of HICP items with a year-on-year increase in prices above two per cent further increased to 70%.

As indicated in the April 2022 Monetary Policy Statement, measures of underlying inflation have risen to levels above two per cent in recent months. In March 2022, the HICP inflation rate excluding energy and food was 2.9 per cent, the highest rate recorded since the introduction of the euro in 1999. Moreover, while various measures of longer-term inflation expectations derived from financial markets and from expert surveys continue to largely stand at around two per cent, initial signs of above-target revisions in some measures warrant close monitoring of the risk of a potential de-anchoring of longer-term inflation expectations.

With the incoming data since the March 2022 Governing Council meeting reinforcing the expectation that net asset purchases under the APP should be concluded in the third quarter of 2022, the April 2022 Monetary Policy Statement does not explicitly reiterate the conditionality of a decision to conclude net purchases under the APP in the third quarter spelt out in the March 2022 Monetary Policy Statement, namely that incoming data support the expectation that the medium-term inflation outlook will not weaken even after the end of net asset purchases.

Nor does the April 2022 Monetary Policy Statement recall the sentence from the March 2022 statement that if the medium term inflation outlook changes and if financing conditions become inconsistent with further progress towards the two per cent target, the Governing Council stands ready to revise its schedule for net asset purchases in terms of size and/or duration.

At the same time, the April 2022 Monetary Policy Statement acknowledges several factors pointing to slow growth in the period ahead. The invasion of Ukraine, for instance, may have an even stronger effect on the confidence of consumers and businesses and could exacerbate supply-side constraints. High energy costs, too, may weigh on consumption and investment more than expected.[8]

While the Governing Council is very attentive to the current uncertainties and will maintain optionality, gradualism and flexibility in the conduct of monetary policy, for now, the incoming data confirm the expectation that net asset purchases may have soon fulfilled their objective. In line also with the principle of proportionality[9], it would therefore not at all be groundless to expect an end of net asset purchases by the end of the second quarter of 2022.

Also beyond a discontinuation of net asset purchases under the APP, the Governing Council’s monetary policy will continue to depend on the incoming data and the Governing Council’s evolving assessment of the outlook.

Against this background, as announced by the Governing Council in March 2022, an adjustment to the key ECB interest rates will take place “some time after” the end of net asset purchases and will be gradual. The timing of a first rate hike will be determined by the Governing Council’s forward guidance and by its strategic commitment to stabilise inflation at 2% over the medium term.[10]

While there is no doubt that inflation pressures further intensified compared to the previous Governing Council meetings, Russia’s aggression towards Ukraine causes shocks to growth and inflation to opposite effects. The outlook is notoriously uncertain, obscured by a non-negligible risk of a “sudden disorderly unwinding” that potentially could suppress the recovery and growth path of the euro area or put to a test the resilience of financial markets.

Without prejudice to these very elevated uncertainties, which underscore the need for optionality, flexibility and gradualism in the conduct of monetary policy now and going forward, the April 2022 Monetary Policy Statement paves the way for a first gradual rate hike already in July 2022 or in September 2022 at the latest. Furthermore, it could lead to further gradual policy rate adjustments later in the year, potentially bringing the level of the interest rate on the Eurosystem’s deposit facility to zero per cent by the end of 2022.[11]

____________________________

[1] See the blog article “The February 2022 ECB Governing Council: Monetary policy decisions confirmed, monetary policy statement recalibrated”.

[2] See the blog article “The March 2022 ECB Governing Council monetary policy decisions. Reassessing the inflation outlook and recalibrating monetary policy normalisation”.

[3]On 16 December 2021, the Governing Council had announced that monthly net purchases under the APP would amount to €40 billion in the second quarter of 2022, €30 billion in the third quarter and €20 billion from October onwards for as long as necessary to reinforce the accommodative impact of its policy rates.

[4] Previously, the Governing Council expected net purchases to end shortly before it started raising the key ECB interest rates.

[5] The expression “some time after”, ECB President Lagarde declared at press conferences following the March and the April 2022 Governing Council meetings, opens sufficiently wide an interval of time, including the week after, but also months later, depending on the medium-term inflation outlook.

[6] On 17 March 2022, Eurostat released the full set of HICP data for February 2022 and reported an inflation rate of 5.9 per cent.

[7] On 21 April 2022, Eurostat released the full set of HICP data for March 2022 and reported an inflation rate of 7.4 per cent.

[8] Accordingly, the April 2022 Monetary Policy Statement states that the Governing stands ready to adjust all of its instruments within its mandate, incorporating flexibility if warranted, to ensure that inflation stabilises at the two per cent target over the medium term.

[9] Proportionality is one of the basic legal principles of the architecture of the European Union and enshrined in European Union law. As far as monetary policy is concerned, from an economic perspective, proportionality implies 1) that the ECB’s actions must be suitable to address the identified risks to price stability; 2) that the ECB’s actions must be necessary to achieve their intended objective and 3) that the expected benefits of the ECB’s actions must outweigh their costs.

[10] The Governing Council continues to expect the key ECB interest rates to remain at their present levels until it sees inflation reaching 2% well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at 2% over the medium term.

[11] The rate at which counterparties may make overnight deposits at a Eurosystem national central bank has been negative since June 2014. From June 2014 to September 2019 the Governing Council lowered the interest rate on the deposit facility in five steps to -0.50 per cent.