Film about the BCL's missions and tasks

Evolution of credit institutions’ balance sheet

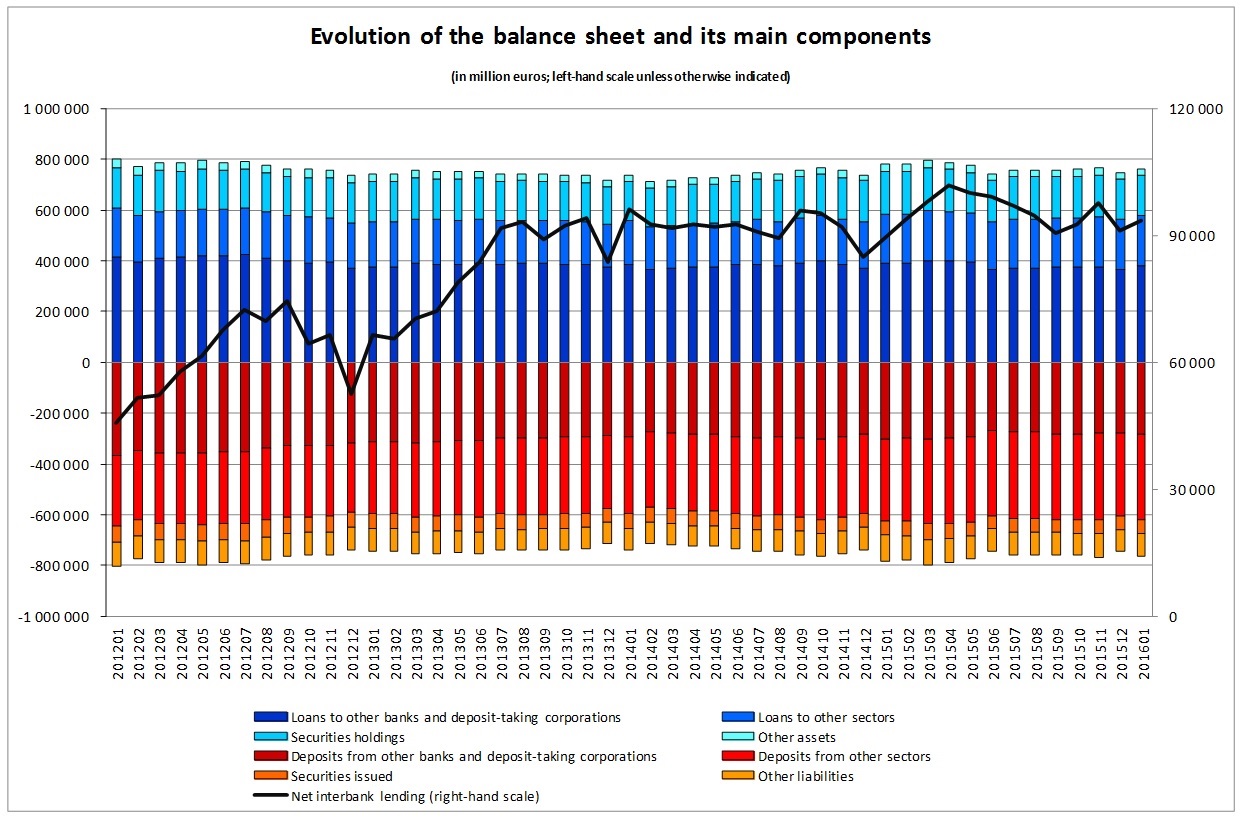

The Banque centrale du Luxembourg informs that, based on preliminary data, the aggregated balance sheet of credit institutions reached 763 046 million euros on 31 January 2016, compared to 746 756 million euros on 31 December 2015, an increase of 2.2%. Between the months of January 2015 and January 2016, the aggregated balance sheet decreased by 2.5%.

Over the last twelve months, assets mainly decreased in light of a progression in interbank loans, which decreased by 3.0% between January 2015 and January 2016. Over the same period, the reduction in liabilities was largely due to interbank deposits, which decreased by 5.2%.

The evolution of interbank loans and deposits has thus a significant impact on assets and liabilities. Indeed, interbank loans and deposits make up 49.7% and 37.4% on the asset and liability side respectively. Against this background, it should be pointed out that net interbank lending, that is to say the difference between interbank loans and deposits, remained positive and reached 93 471 million euros at the end of January 2016.

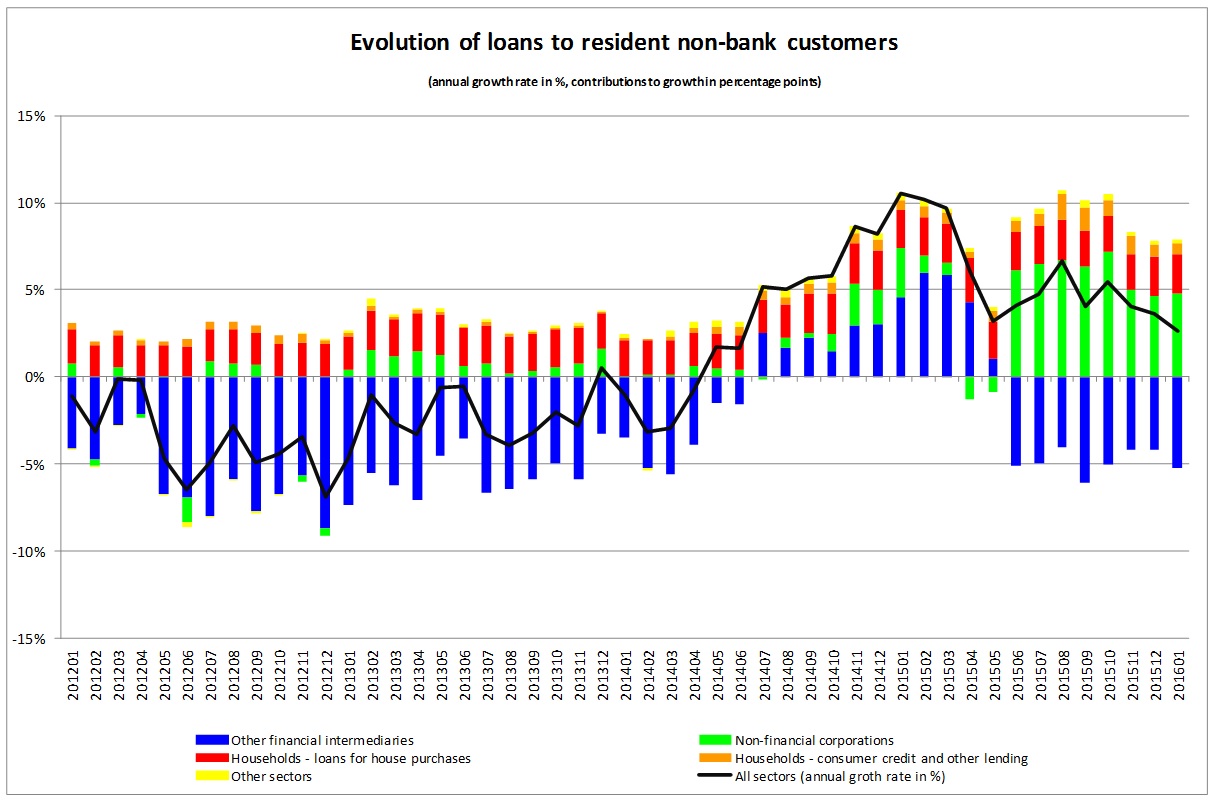

Loans to resident non-bank customers increased by 1 986 million euros, or 2.8%, between December 2015 and January 2016. Between January 2015 and January 2016, these loans increased by 1 909 million euros (2.7%).

The progression of loans to resident non-bank customers was largely attributable to its main components, that is to say loans to non-financial corporations (NFCs), loans to other financial intermediaries (OFIs) and lending to households for house purchases. At end-January 2016, the respective shares of these loans stood at 26.0%, 30.1% and 32.9%. While loans to NFCs and loans for house purchases continued to progress between January 2015 and January 2016, OFI-lending significantly moderated the increase in loans to the resident non-bank sector. Indeed, between January 2015 and January 2016, loans to NFCs rose by 3 457 million euros (22.0%) and loans for house purchase by 1 594 million euros (7.0%), while OFI-lending dropped by 3 746 million euros, or 14.4%. However, it should be noted that the fall in OFI-lending and the concomitant rise in NFC-lending are owing to the reclassification of several large loans from the OFI to the NFC sector.

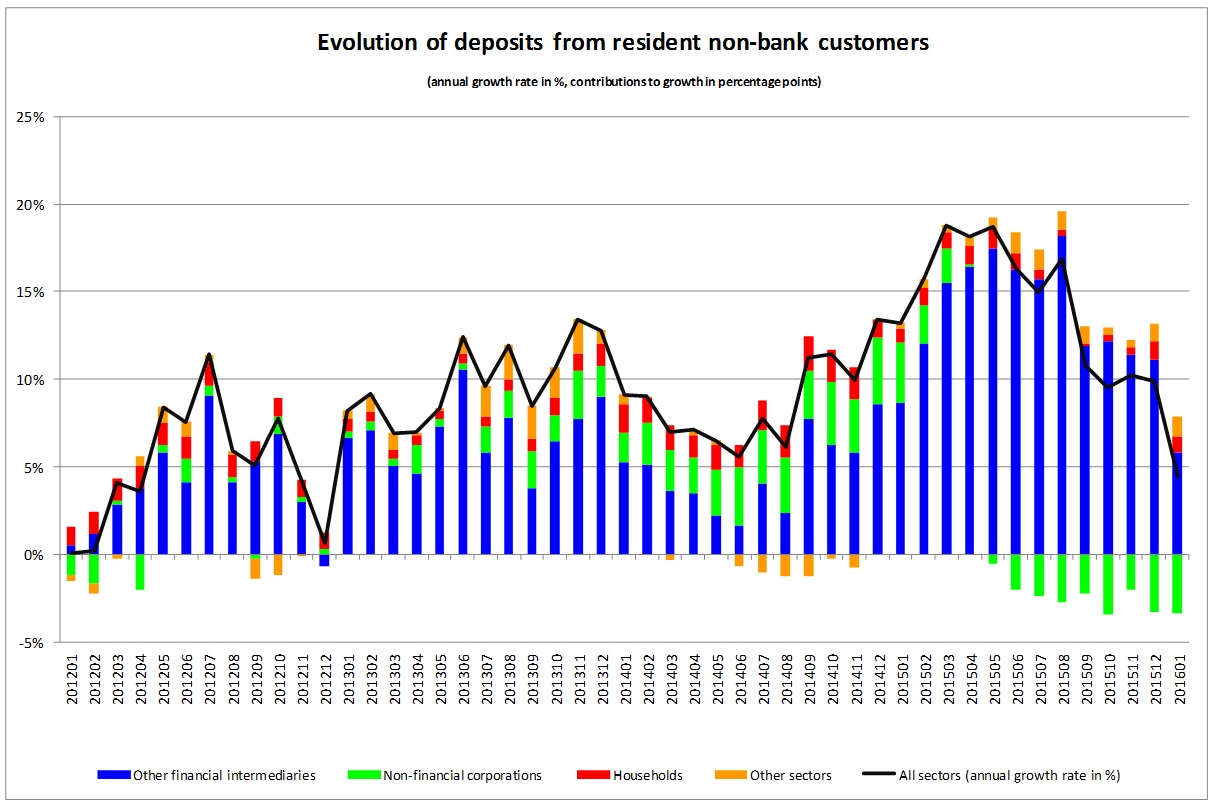

With regard to the liability side, deposits from the resident non-bank sector went up by 9 million euros between 31 December 2015 and 31 January 2016. On an annual basis, these deposits rose by 8 858 million euros, or 4.4%.

Between January 2015 and January 2016, the progression of deposits from the resident non-banking sector was largely attributable to its main component, that is to say deposits from the OFI sector, with a share of 70.0% as at 31 January 2016. Indeed, the year-on-year increase in deposits from the resident non-banking sector was largely due to a rise in OFI deposits, which comprise deposits made by monetary and non-monetary investment funds. Over the last twelve months, resident OFI deposits rose by 11 683 million euros, or 8.7%. With regard to other sectors, resident household deposits increased by 1 795 million euros, or 5.8%, while resident NFC deposits went down by 6 800 million euros (31.9%).

Finally, it should be noted that 143 credit institutions were officially registered in Luxembourg at end-January 2016.

The tables pertaining to the balance sheet of credit institutions can be consulted on the BCL’s website on the following pages.