Film about the BCL's missions and tasks

International investment position at the first quarter of 2025

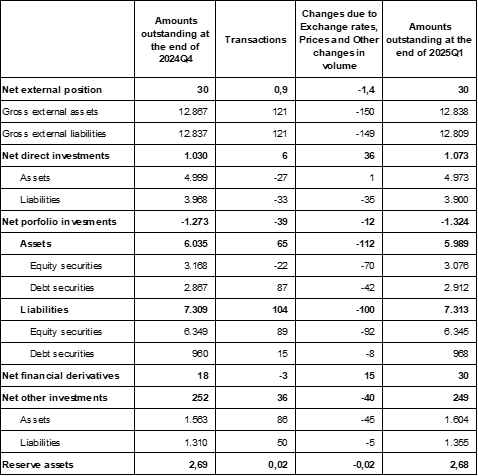

Compared to the fourth quarter of 2024, Luxembourg’s external financial assets slightly decreased by 29,5 billion euros, reaching 12 838 billion euros at the end of the first quarter of 2025. External financial liabilities decreased similarly, reaching 12 809 billion euros for this period. Luxembourg’s international investment position is amounted to 30 billion euros at the end of March 2025.

The outstanding amount in direct investments assets and liabilities decreased and reached respectively 4 973 billion euros and 3 900 billion euros. These results are very much related to negative price and exchange rate effects as well as negative transactions.

Driven by the evolution in financial markets, the outstanding amount in portfolio investments assets reached 5 989 billion euros, i.e. a decrease of 46,6 billion euros, mainly due to negative revaluation and price effects (-112 billion euros), the rest being associated to 65 billion euros of investments. Likewise, the amount outstanding in portfolio investments liabilities reached 7 313 billion euros at the end of March 2025, which represents a small increase of 4,2 billion euros. This increase is mainly due to 104 billion euros of positive transactions and to -100 billion euros of negative price and change effects.

Lastly, the outstanding amount in assets regarding other investments reached 1 604 billion euros at the end of March 2025, which corresponds to an increase compared to the previous quarter. The amount outstanding in liabilities also slightly improved vis-à-vis the previous quarter (44,4 billion euros), reaching 1 355 billion euros at the end of the first quarter of 2025.

Table: Luxembourg International Investment Position (billion euros)

(in billions of EUR)

Source : BCL

Detailed statistical data is available on the BCL’s website on the following page:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/09_iip/index.html