Film about the BCL's missions and tasks

Balance of payments of Luxembourg during the first three quarters of 2025

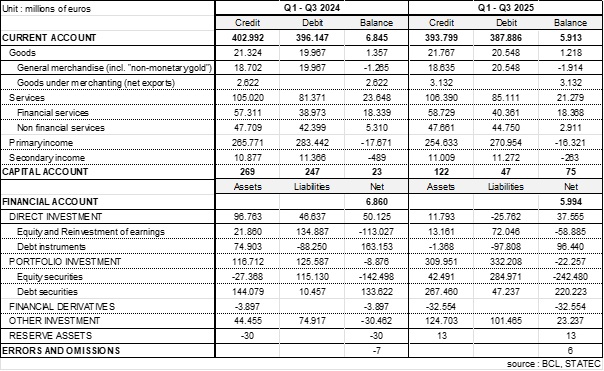

The Banque centrale du Luxembourg (BCL) and STATEC inform that according to the first provisional results, the current account for the first three quarters of 2025 showed a surplus of 5 913 million euros, i.e. a decrease of 932 million euro compared to the same period of the previous year.

The goods surplus stood at 1 218 million euro in the first three quarters of 2025, corresponding to a drop of 139 million euro compared to the same period of the previous year. Indeed, exports of goods increased by 2% while imports augmented even more by 3%. Firstly, net exports from goods under merchanting (purchases of goods abroad and their resale abroad) expanded by 510 million euro. Secondly, general merchandise (i.e. excluding merchanting) exports declined by 0.4% (-67 million euro), while imports grew, by 2.9% (582 million euro).

The balance of international trade in services shrank by 10% in the first three quarters of 2025 (-2 369 million euro) compared to the same period of the previous year, due to the fact that exports increased by 1.3%, but imports much more by 4.6%. In particular, trade in non-financial services remained unchanged for exports (-0.1%), but uncreased a lot for imports (5.5%), thereby reducing the surplus in non-financial services compared to the first three quarters of 2024. International trade in financial services, meanwhile, progressed with 2.5% for exports and 3.6% for imports. This evolution on both sides is driven mainly by an increase in average assets managed by investment funds during the period under review (6%) compared to the same period of the previous year.

In the financial account, direct investments were slightly positive in the first three quarters of 2025 for assets (11.8 billion euro) and negative for liabilities (-25,7 billion euro, largely due to intra-group loans), compared to strong positive investments on both asset and liability side in the first three quarters of 2024.

Regarding portfolio investments, Luxembourg equities, driven by Investment Funds (IF) shares recorded net inflows, reaching 284.9 billion euro during the first three quarters of 2025, compared to net inflows of 115.1 billion euro in the first three quarters of the previous year. On their side, transactions in foreign equities were positive in the first three quarters of 2025 (42.5 billion euro) in contrast to the same period in 2024 (-27.3 billion euro). Moreover, resident institutions, above all Money Market Funds and non-MMF Investment Funds, purchased foreign debt securities (267.4 billion euro).

Luxembourg debt securities recorded net inflows of 47.2 billion euro, which corresponds to an increase vis-à-vis the first three quarters of 2024 (10.4 billion euro).

Resident deposit-taking corporations and other resident institutions also increased their Other Investments abroad, mostly deposits and loans (124.7 billion euro). Non-resident investors also increased their Other Investments in Luxembourg (101.5 billion euro), in particular loans granted to non-MMF Investment Funds.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg