Film about the BCL's missions and tasks

Balance of payments of Luxembourg during the first three quarters of year 2020

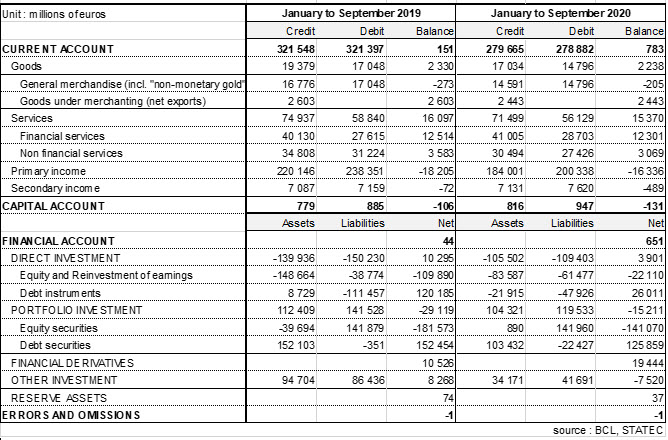

The Banque centrale du Luxembourg (BCL) and STATEC inform that the current account showed a surplus of 788 million euros in the first three quarters of 2020.

The goods balance fell by 92 million euros (-4 %). Indeed, the fall in net exports from merchanting (-160 million) was only partially absorbed by the increase in the general merchandise balance (+68 million). Both exports and imports of goods fell significantly during the first three quarters of 2020, with -12 % and -13 % respectively. This development is linked to the slowdown or shutdown of certain branches of the economy (and neighbouring economies) following the various restrictive measures put in place by the authorities in the context of the health crisis, especially in the second quarter.

International trade in services fell by 4.6 % during the three quarters of 2020, corresponding to around -3.4 billion euros for exports and -2.7 billion for imports. The surplus of services fell by 722 million (-4.5 %). Unlike previous (financial) crises, financial services were only slightly impacted by the health crisis and even showed growth rates of + 2.2 % for exports and +3.9 % for imports during the period under review. Trade in non-financial services, for its part, suffered a similar decline to that of goods (around -12 %). The services most affected were travel services, other business services, and personal, cultural and recreational services.

Concerning secondary income, the increase in expenditure (debit) is to be seen in relation to the social security benefits paid to cross-border workers during confinement (partial unemployment, extraordinary leave for family reasons, etc.).

In the financial account, during the first three quarters of 2020, direct investment flows were still characterized by disinvestment operations for both assets (-105 billion euros) and liabilities (-109 billion euros). These operations concerned a small number of SOPARFIs that continued restructuring, ceasing or relocating their activities.

Regarding portfolio investments, the second and the third quarters of 2020 were characterized by the resumption of investments in Luxembourg equities (largely Investments Funds shares), after the net sales observed in the first quarter of 2020, in a context of falling stock prices following the Covid-19 pandemic. Transactions in Luxembourg equity shares thus resulted in net inflows of 142 billion euros in the first three quarters of 2020. Luxembourg debt securities, however, suffered net sales of 22 billion euros in the first three quarters of 2020. Transactions in foreign equity securities resulted in low net purchases in favor of foreign debt securities, which underwent large net purchases, amounting to 103 billion euros in the first three quarters of 2020.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg

For further information, please contact:

- STATEC - Mr. Bley at 247-84393

- BCL - « Communication » section at 4774-4265 ou 4599