Film about the BCL's missions and tasks

Balance of payments of Luxembourg during the year 2021

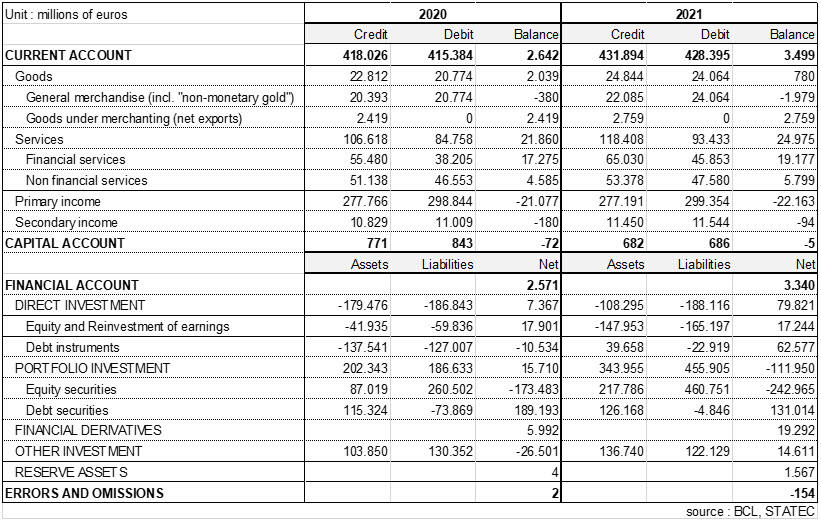

The Banque centrale du Luxembourg (BCL) and STATEC inform that, according to the first provisional results, the current account for 2021 showed a surplus of 3 499 million euros, an increase of 32% compared to 2020 (+858 million euros).

The goods surplus stood at 780 million euros and fell greatly in 2021 (-1 258 million). Both exports and imports of goods, however, showed significant increases of around 9%, respectively 16%. First, net exports from goods under merchanting (purchases of goods abroad and their resale abroad) were up 14% (+340 million euros). For general merchandise (i.e. excluding merchanting), exports went up 8% (+1 692 million euros), while imports increased by 16% (+3 290 million euros).

The balance of international trade in services increased by 14% in 2021 (+3 115 million euros), due to the fact that exports and imports have increased at a sustained pace, with 10% each. At the level of sub-items however, evolutions were more contrasted. Trade in non-financial services increased for exports (+4%) and imports (+2%). International trade in financial services, meanwhile, posted strong growth, with +17% for exports and +20% for imports. This evolution was driven mainly by the significant appreciation in assets managed by investment funds during the period under review (+18%).

In the financial account, during the year 2021, direct investment flows were still characterized by disinvestment operations for both assets (-108 billion euros) and liabilities (-188 billion euros). These operations concerned a small number of SOPARFIs that continued restructuring, ceasing or relocating their activities.

Regarding portfolio investments, following the improvement in the financial markets, transactions in Luxembourg equities (largely Investments Funds shares), resulted in net inflows of 461 billion euros during the year 2021, compared with net inflows of 260 billion euros in 2020. Transactions in foreign equity securities resulted in net purchases of 218 billion euros during the year 2021, compared to net purchases of 87 billion euros in 2020. On the other hand, Luxembourg debt securities continued to experience net sales, although at a slower pace, reaching down 5 billion euros in 2021 compared with net sales of 74 billion euros in 2020. This development can be explained, among other things, by lower activity in securities issues by Captive Financial Institutions. Foreign debt securities, for their part, underwent net purchases, amounting to 126 billion euros in 2021, compared with net purchases of 115 billion euros in 2020. The later development is explained by the relatively high yield rates of foreign debt securities, particularly for securities issued by the United States, the United Kingdom and emerging countries.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg