Film about the BCL's missions and tasks

Interest rates

The Banque centrale du Luxembourg (BCL) informs that, based on preliminary data, the main interest rates applied by Luxembourg’s credit institutions to euro area households and non-financial corporations (NFCs) for their loans and deposit operations have on average evolved as follows in April 2017.

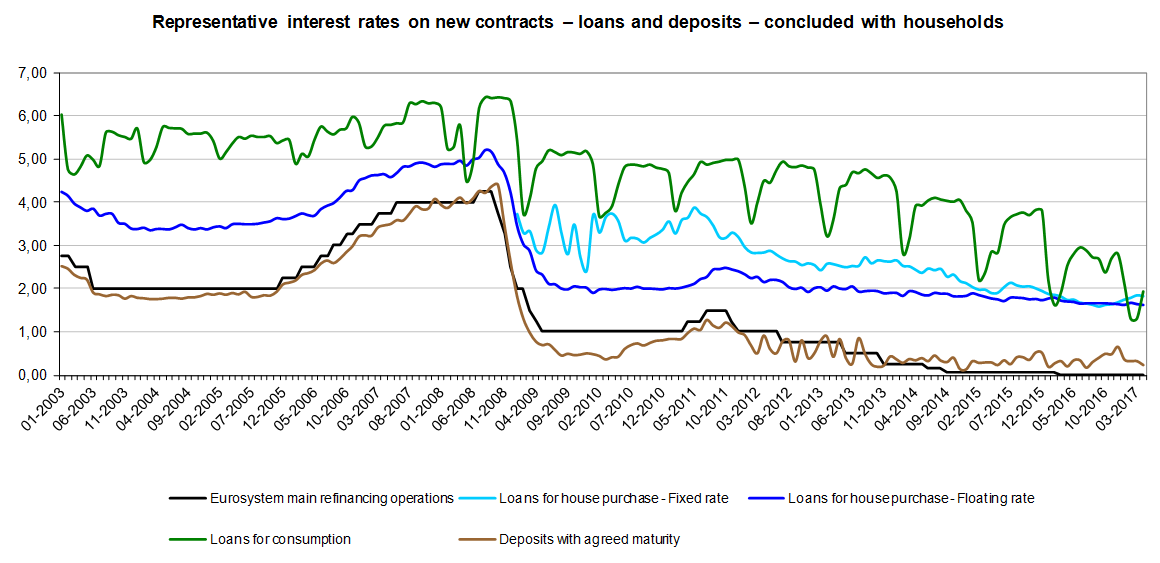

Representative interest rates on new contracts[1] – loans and deposits – concluded with households

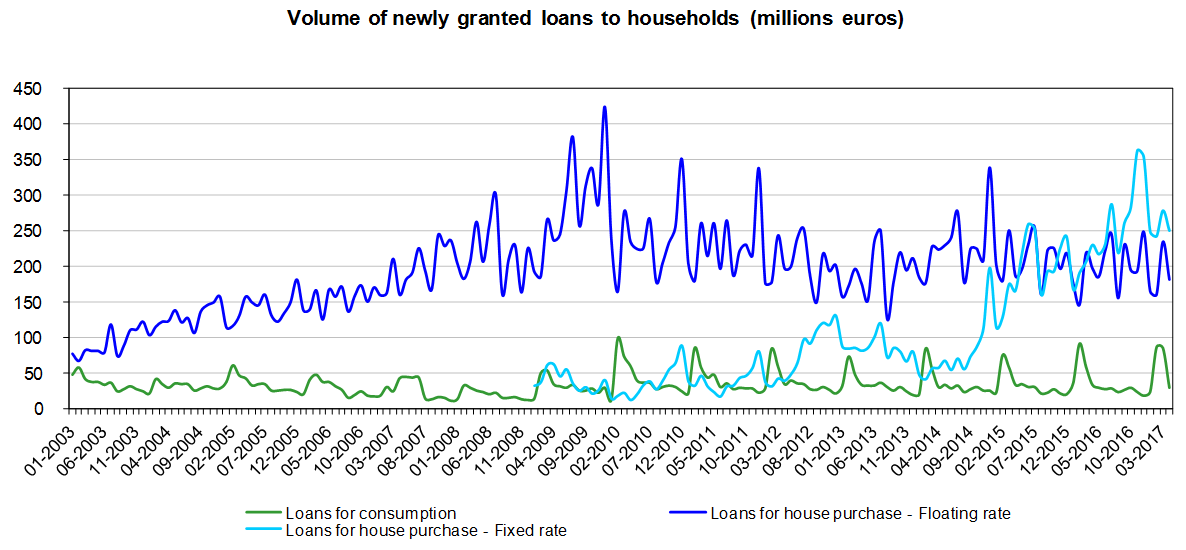

The variable[2] interest rate on mortgage loans granted to households has decreased by 2 basis points on a monthly basis, reaching 1.63% in April 2017. The volume of these newly granted loans has decreased by 53 million euros on a monthly basis to reach 181 million euros during last reference period. On a yearly basis, the interest rate has declined by 8 basis points whereas the volume of newly granted loans has decreased by 16 million euros.

The fixed[3] interest rate on mortgage loans granted to households has decreased by 2 basis points on a monthly basis to reach 1.81% during April 2017. The volume of these newly granted loans has decreased by 28 million euros on a monthly basis and has consequently amounted to 249 million euros during the last reference period. On a yearly basis, this interest rate has increased by 9 basis points whereas the volume of newly granted loans has increased by 20 million euros.

The interest rate on consumer loans that have an initial fixation period above 1 year and below or equal to 5 years has increased by 63 basis points compared to March 2017, reaching 1.92% in April 2017. The volume of these newly granted loans has decreased by 55 million euros on a monthly basis and has consequently amounted to 29 million euros. On a yearly basis, this interest rate has decreased by 60 basis points and the volume of newly granted loans has decreased by 4 million euros.

The interest rate on households’ fixed-term deposits that have an initial maturity below or equal to 1 year has decreased by 9 basis points on a monthly basis, reaching 23 basis points during April 2017.

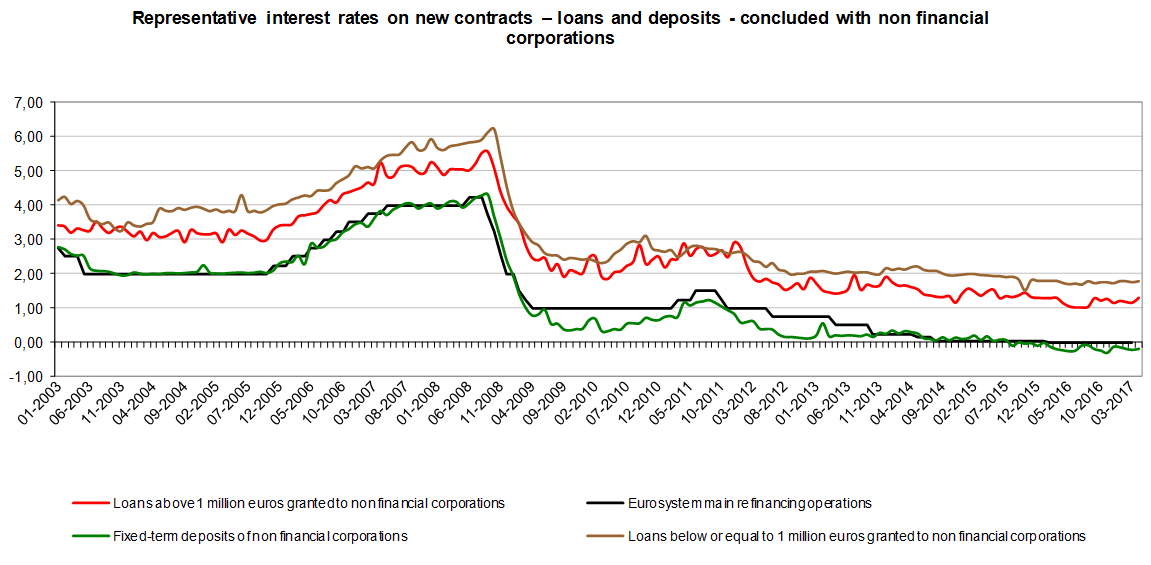

Representative interest rates on new contracts1 – loans and deposits – concluded with NFCs

The variable2 interest rate on loans below or equal to 1 million euros granted to NFCs has increased by 3 basis points on a monthly basis, reaching 1.79% in April 2017. The volume of newly granted loans has decreased by 73 million euros, reaching 775 million euros during the last reference period. On a yearly basis, this interest rate has increased by 5 basis points whereas the volume of newly granted loans has decreased by 35 million euros.

The variable2 interest rate on loans above 1 million euros granted to NFCs has increased by 14 basis points, reaching 1.32% during April 2017. The volume of these newly granted loans has decreased by 2 635 million euros on a monthly basis and has consequently reached 4 833 million euros. On a yearly basis, this interest rate has increased by 15 basis points and the volume of newly granted loans has decreased by 1 443 million euros.

The interest rate on fixed-term deposits of NFCs with an initial maturity below or equal to 1 year has increased by 3 basis points on a monthly basis, reaching -19 basis points in April 2017.

The tables pertaining to interest rates applied to credit institutions can be consulted and/or downloaded on the BCL’s website on the following pages:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/03_Capital_markets/index.html

[1] New contracts refer to any new agreement concluded between the household or the non-financial corporation and the reporting agent. New contracts include all financial contracts which mention for the first time the interest rate pertaining to the deposit or credit and all renegotiations of existing deposits or credits.

[2] Variable interest rate or rate with an initial fixation period inferior or equal to 1 year.

[3] Fixed interest rate weighted by the amounts of contracts for all mortgage loans granted, whatever the initial rate fixation period (above 1 year). This series has been published by the BCL only since February 2009 because of methodological reasons linked to the identification of reporting agents.