Film about the BCL's missions and tasks

International investment position at the end of December 2017

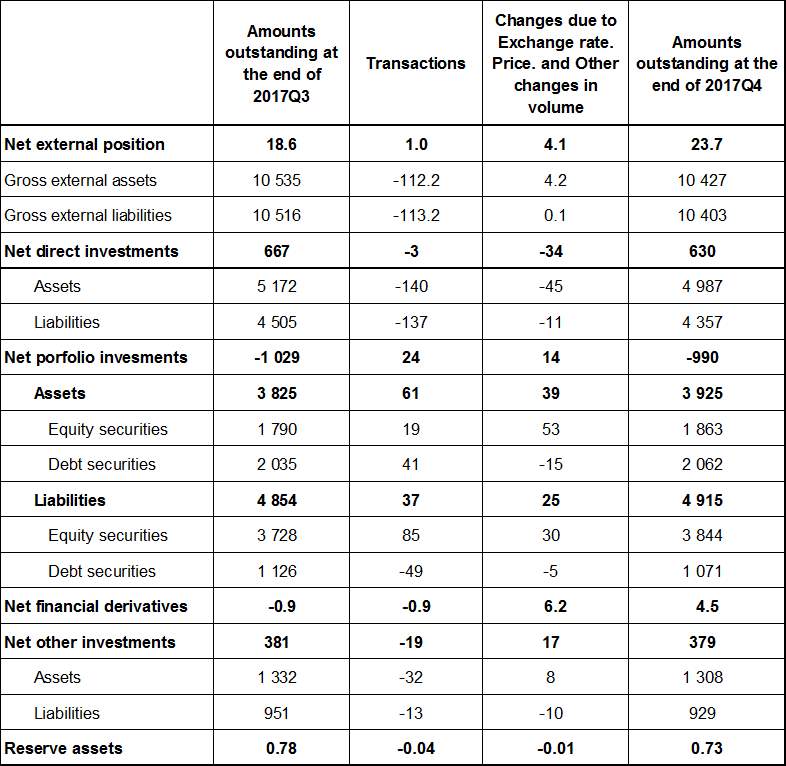

Compared to the third quarter of 2017, Luxembourg’s external financial assets decreased by 108 billion euros to reach 10 427 billion euros at the end of the last quarter of 2017. External financial liabilities decreased by 113 billion euros and reached 10 403 billion euros at the end of December 2017. Luxembourg’s net international investment position, which corresponds to the difference between external financial assets and liabilities, thus increased by 5 billion euros and reached 24 billion euros at the end of the last quarter of 2017. This improvement of the net international investment position is largely attributed to a positive impact of revaluations.

In the various components of the net external position, the net asset position in direct investments decreased by 37 billion to reach 630 billion euros at the end of December 2017. The net asset position in the other investments (deposits and traditional credits, trade credits, other receivables or payables) decreased by 2 billion euros and reached 379 billion euros, while the balance in the financial derivatives improved largely by 5 billion euros. The structural net liability position in the portfolio investments increased by 39 billion to reach 990 billion euros at the end of December 2017.

The amount outstanding in direct investments assets reached up 4 987 billion euros at the end of December 2017, having undergone large negative transactions (disinvestment of 140 billion euros), and large negative revaluation effects (-45 billion euros). The amount outstanding in direct investments liabilities decreased by 148 billion euros reaching up 4 357 billion euros at the end of December 2017. The later drop was also triggered by large outflows (137 billion euros), as well as by large negative revaluation effects (-11 billion euros).

The amount outstanding in portfolio investments assets reached up 3 925 billion euros at the end of December 2017, after having increased by 100 billion euros which resulted from positive transactions (61 billion euros), as well as from positive revaluation effects (39 billion euros). The amount outstanding in portfolio investments liabilities reached 4 915 billion euros at the end of December 2017, after having increased by 61 billion euros which resulted from positive transactions (37 billion euros), as well as from positive revaluation effects (24 billion euros).

For other investments, the amount outstanding in assets decreased by 24 billion euros down to 1 308 billion euros at the end of December 2017, as positive revaluation effect (8 billion euros) was fully offset by negative transactions. The amount outstanding in liabilities also decreased by 22 billion euros, down to 929 billion euros at the end of December 2017. The later decrease was explained by negative transactions, as well as a negative revaluation effect.

Table : Luxembourg International Investment Position (billion euros)

Source: BCL

Detailed statistical data is available on the BCL’s website on the following page:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/09_iip/index.html