Film about the BCL's missions and tasks

International investment position at the end of March 2018

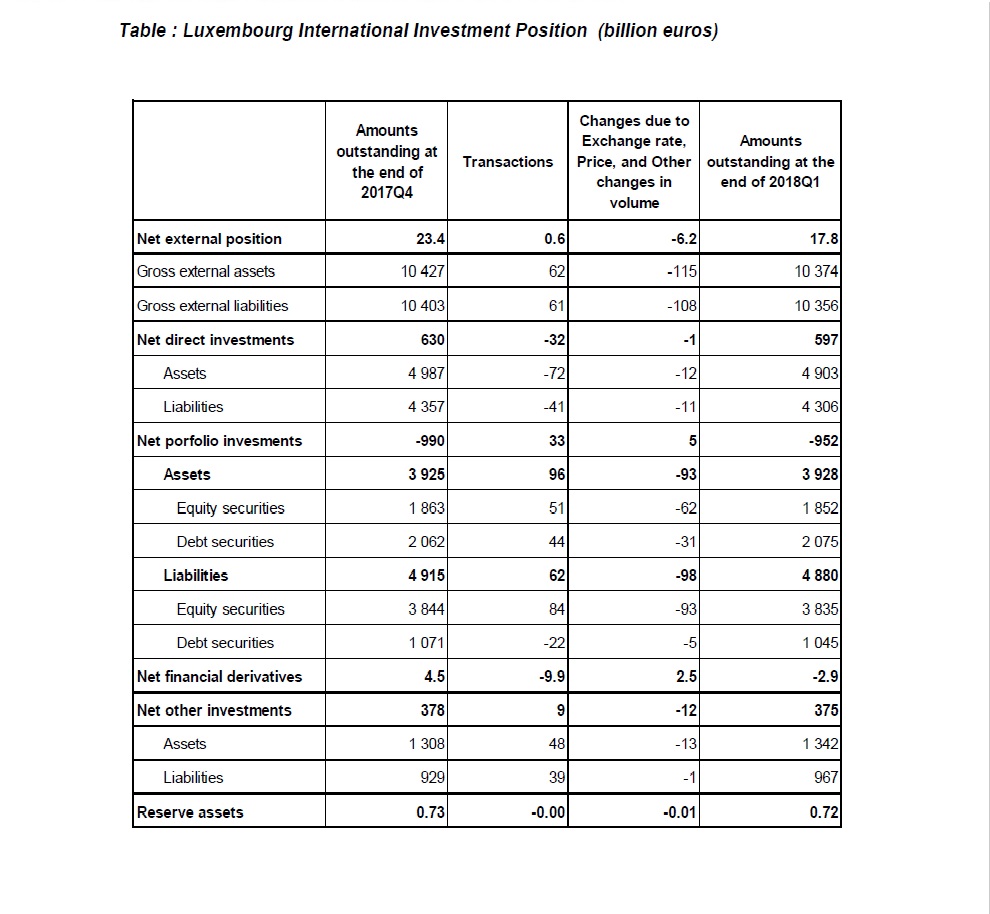

Compared to the last quarter of 2017, Luxembourg’s external financial assets decreased by 53 billion euros to reach 10 374 billion euros at the end of the first quarter of 2018. External financial liabilities also decreased by 47 billion euros and reached 10 356 billion euros at the end of March 2018. Luxembourg’s net international investment position, which corresponds to the difference between external financial assets and liabilities, thus decreased by 5 billion euros and reached 18 billion euros at the end of first quarter of 2018. This deterioration of the net international investment position is largely attributed to a negative impact of revaluations.

In the various components of the net external position, the net asset position in direct investments decreased by 33 billion to reach 597 billion euros at the end of March 2018. The net asset position in the other investments (deposits and traditional credits, trade credits, other receivables or payables) decreased by 3 billion euros and reached 375 billion euros. The structural net liability position in the portfolio investments decreased by 38 billion to reach 952 billion euros at the end of March 2018.

The amount outstanding in direct investments assets reached up 4 903 billion euros at the end of March 2018, having undergone large negative transactions (disinvestment of 72 billion euros), and negative revaluation effects (-12 billion euros). The amount outstanding in direct investments liabilities decreased by 51 billion euros reaching down 4 306 billion euros at the end of March 2018. The later drop was also triggered by large outflows (41 billion euros), as well as by negative revaluation effects (-11 billion euros).

The amount outstanding in portfolio investments assets reached up 3 928 billion euros at the end of March 2018, after having increased by 3 billion euro which resulted from positive transactions (96 billion euros) that were, however, largely offset by negative revaluation effects (93 billion euros). The amount outstanding in portfolio investments liabilities reached 4 880 billion euros at the end of March 2018, after having decreased by 35 billion euros which resulted from negative revaluation effects (-98 billion) that were only partially offset by positive transactions (62 billion euros).

For other investments, the amount outstanding in assets increased by 35 billion euros up to 1 342 billion euros at the end of March 2018, as negative revaluation effects (-13 billion euros) were fully offset by positive transactions (48 billion euros). The amount outstanding in liabilities also increased by 38 billion euros, up to 967 billion euros at the end of March 2018. The later increase was explained by positive transactions.

Detailed statistical data is available on the BCL’s website on the following page:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/09_iip/index.html