Film about the BCL's missions and tasks

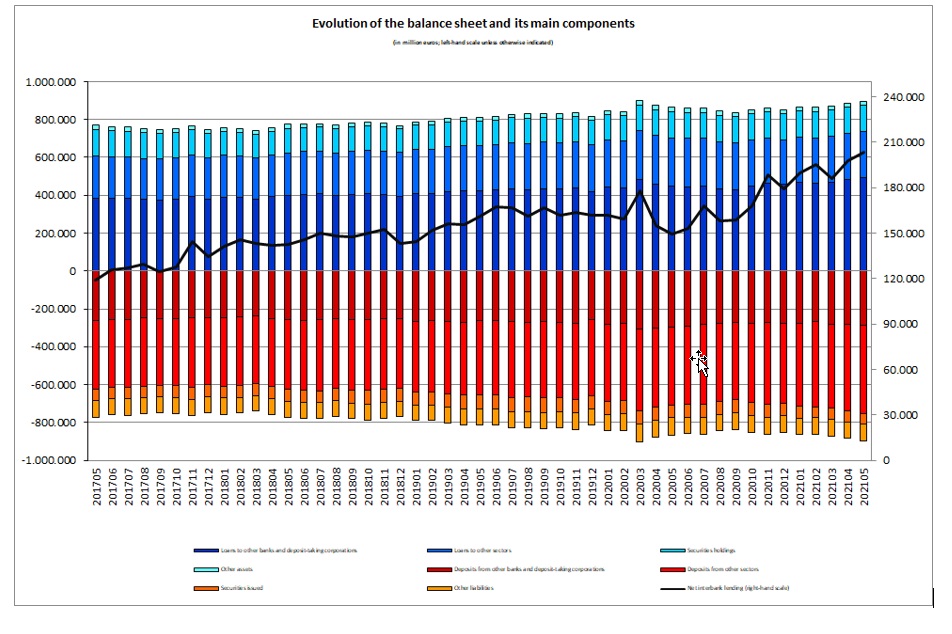

Evolution of credit institutions’ balance sheet

The Banque centrale du Luxembourg informs that, based on preliminary data, the aggregated balance sheet of credit institutions reached 896 962 million euros on 31 May 2021, compared to 884 707 million euros on 30 April 2021, an increase of 1.39%. On an annual basis, the aggregated balance sheet increased by 3.7%.

Net interbank lending, i.e. the difference between interbank loans and deposits, increased by 5 518 million euros (2.8%) to reach 203 595 million euros at the end of May 2021.

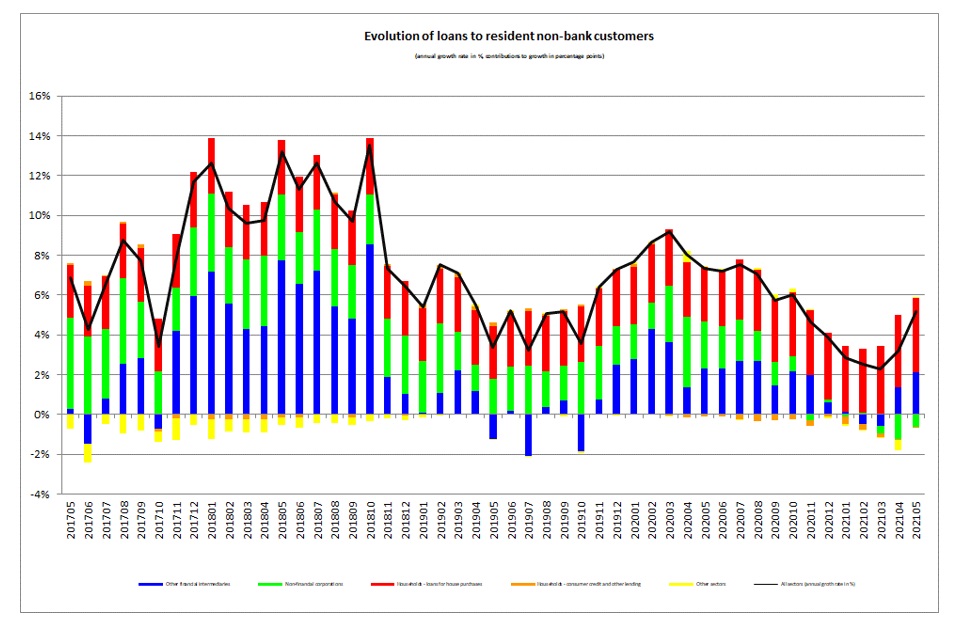

Loans to resident non-bank customers increased by 1 243 million euros, or 1.2%, between April and May 2021. Over twelve months, these loans increased by 5 219 million euros (5.2%).

On a yearly basis, loans to non-financial corporations (NFCs) decreased by 609 million euros (2.1%), loans for house purchases increased by 3 759 million euros (11.1%) and loans to other financial intermediaries (OFIs) increased by 2 141 million euros (7.1%).

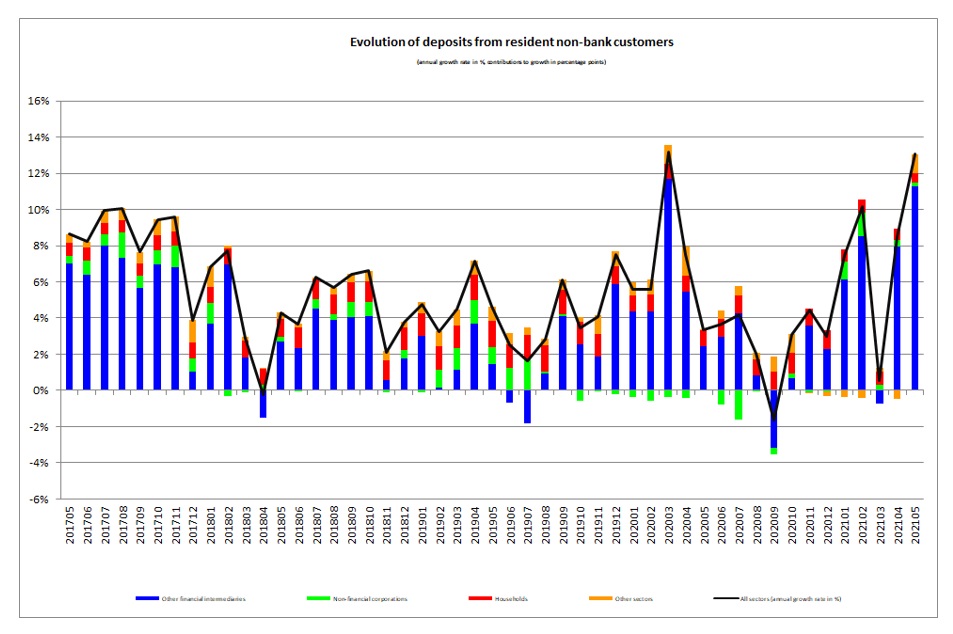

With regard to the liability side, deposits from the resident non-bank sector increased by 3 966 million euros or 1.4% between April and May 2021. Over twelve months, these deposits increased by 33 993 million euros, or 13,0%.

Between May 2020 and May 2021, Other financial intermediaries (OFI) deposits (which had a share of 70.8% as at 31 May 2021 and comprised deposits made by monetary and non-monetary investment funds) increased by 29 339 million euros (16.4%) and household deposits by 1 346 million euros (3.1%). NFC deposits increased by 606 million euros (3.3%) and deposits from the other sectors[1] increased by 2 702 million euros (13.2%).

The tables pertaining to the balance sheet of credit institutions can be consulted on the BCL’s website on the following page:

http://www.bcl.lu/en/statistics/series_statistiques_luxembourg/11_credit_institutions/index.html

[1] General government, insurance corporations and pension funds.