Film about the BCL's missions and tasks

Balance of payments of Luxembourg for the first half of 2018

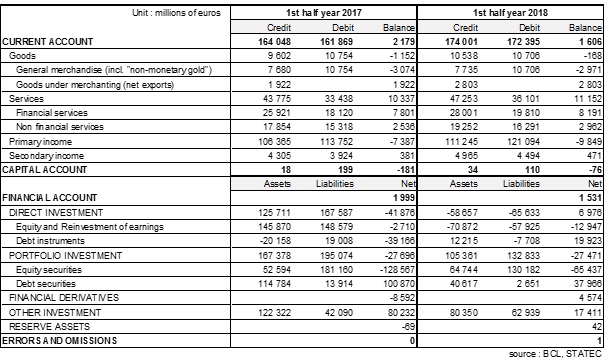

The Central Bank of Luxembourg (BCL) and STATEC inform that, according to preliminary provisional results, the current account for the first half-year of 2018 showed a surplus of 1.6 billion euros, which decreased by 573 million compared to the same period of the previous year. Higher surpluses in goods, services and secondary income did not manage to offset the worsening in the deficit of the primary income, particularly that of investment income.

As a result of a significant increase in net exports of goods under merchanting (46%), the goods deficit decreased by almost 1 billion euros to 168 million. This development is mainly due to the change in structure of a major player in e-commerce. The virtual stagnation of the balance of general merchandise conceals divergent developments at a more detailed level: imports of petroleum and chemical products were still rising sharply (+14%), but they were offset by a significant decrease (-17%) in purchases of transport equipment (a.o. aircraft and satellites).

Over the period under review, exports and imports of services increased by around 8%. The growth of financial services was related to that of net assets managed by investment funds (8.2% on a six months average). Non-financial services also went up, mainly due to other business services, insurance services and personal, cultural and recreational services.

In the financial account, direct investment flows were dominated by disinvestment operations for both assets (-59 billion euros) and liabilities (-66 billion euros). These operations concerned a small number of SOPARFIs that ceased or relocated their activities. Regarding portfolio investment, non-resident investments in Luxembourg equities (largely Investments Funds shares) widely decreased, reaching 130 billion euros in the first semester of 2018, compared to 181 billion euros in the first semester of 2017. On the other hand, long-term debt securities incurred net purchases of 2.6 billion euros in the first half of 2018, compared to 14 billion euros in the same half of 2017. Securities issued by Luxembourg thus resulted into net inflows of 133 billion euros in the first semester of 2018, compared to net inflows of 195 billion euros in the same semester of 2017. With regard to foreign securities, residents decreased their investments in the first semester of 2018, which totalled 105 billion euros compared to 167 billion in the first semester of 2018. Portfolio investment flows resulted in steady net inflows of 27 billion euros in the first semester of 2018, offset entirely by the net outflows in other investments and in direct investment flows.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg

For further information, please contact:

- STATEC - Mr. Bley at 247-84393

- BCL - « Communication » section at 4774-4265 ou 4243