- European Central Bank publications

3/ Unconventional monetary policy tools adopted before 2020

20 May 2021

Blog post by Gaston Reinesch, Governor of the BCL

The previous blog article discussed the conventional monetary policy tools. This article provides an overview of the main unconventional monetary policy measures adopted by the Eurosystem between the global financial crisis of 2007-2008 and the outbreak of the COVID-19 pandemic in 2020 with focus on tools that are currently in operation.

Fixed rate full allotment

The previous blog article described how the Eurosystem had steered interbank rates close to the interest rate on main refinancing operations rate before the global financial crisis. After Lehman Brothers filed for bankruptcy in September 2008, lack of confidence among banks caused the supply of interbank credit to collapse, triggering a steep rise in the cost of interbank credit across the world. The interbank market plays a central role in the short-term financing of the euro area economy and in the transmission of monetary policy. If money markets are impaired, monetary policy signals are unlikely to be fully transmitted to the real economy.

The Eurosystem responded to these developments by lowering key policy rates and by implementing several non-standard measures. A key measure was the introduction of the “fixed rate full allotment” tender procedure in all refinancing operations in October 2008.[1] Under fixed rate full allotment the Eurosystem satisfies all demands for central bank liquidity by eligible financial institutions against adequate collateral and on the condition of financial soundness. Since its introduction fixed rate full allotment promoted the effective monetary policy transmission and contributed to aligning money and credit market conditions with the Governing Council’s monetary policy stance (at the cost of increased intermediation through the Eurosystem). In December 2020, the Governing Council decided to continue conducting regular lending operations as fixed rate tender procedures with full allotment at the prevailing conditions for as long as necessary.

Forward guidance

Central bank forward guidance consists of providing information concerning future policy intentions to influence monetary policy expectations. Clear communication about future monetary policy intentions improves the understanding of economic agents (e.g. financial market participants, businesses and consumers) of how borrowing costs are likely to evolve. To be effective, forward guidance requires credibility as to the willingness and the ability of central banks to act according to their guidance. At the same time, forward guidance may not undermine the flexibility of central banks to address unexpected future events.

The Governing Council started using forward guidance in July 2013, announcing - based on its assessment of the outlook for price stability - that it expected interest rates to remain low for an extended period of time. Thanks to its forward guidance, the Governing Council could lower further the expected level of future short-term interest rates, limit the volatility of interest rate expectations, contribute to lower longer-term interest rates, and provide additional expansionary stimulus. Since 2013, the formulation of the Governing Council’s forward guidance has been adjusted on various occasions. For now, the Governing Council expects ECB key interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within the projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics. While initially limited to the expected future path of the ECB’s key interest rates, the Governing Council’s forward guidance now also clarifies its intentions with regard to the horizon of its asset purchase programmes (see below).

Negative interest rate on the deposit facility

Prior to the global financial crisis, the mainstream view was that interest rates had to be zero or slightly positive at least (hence the reference to the “zero lower bound” on nominal short-term interest rates).[2] Any attempt to lower interest rates on deposits below zero, it appeared, would lead depositors to switch from commercial banks deposits to cash and lead commercial banks to switch from central bank deposits to cash[3] or would induce banks to increase their lending rates (and thereby choke off the desired expansionary impulse). In practice, while several central banks introduced slightly negative policy rates after the global financial crisis[4] no significant substitution into cash has been observed yet. [5]

A negative deposit facility rate is unconventional because it implies that banks face costs when placing deposits with their National central bank (NCB).[6] By implementing negative policy rates, the Governing Council could lower further short-term interest rates and, through expectations of lower future short-term interest rates, contribute to lower longer-term interest rates, thereby providing additional expansionary stimulus.

Targeted longer-term refinancing operations (TLTROs)

Unlike the conventional longer-term refinancing operations, TLTROs are targeted operations, as the amount that banks can borrow is not only subject to adequate collateral, but also linked to their loans to non-financial corporations and households (except loans to households for house purchases). A first series of TLTROs was announced in June 2014, a second series (TLTRO II) in March 2016 and a third series (TLTRO III) in March 2019. In TLTRO II and III, the interest rate at which banks can borrow is also linked to the participating banks’ lending patterns. The more loans participating banks issue to non-financial corporations and households (except loans to households for house purchases), the more attractive the interest rate on their TLTRO borrowings becomes. By offering banks long-term funding at attractive conditions they preserve favourable borrowing conditions for banks and stimulate bank lending to the real economy, thereby strengthening the transmission of monetary policy and reinforcing the Governing Council’s accommodative monetary policy stance.

Expanded Asset Purchase Programme (APP)

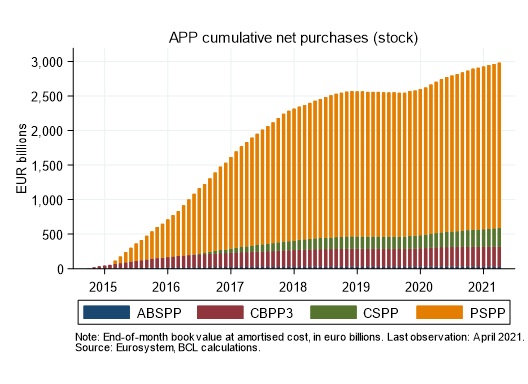

Asset purchases have long been part of the Eurosystem’s operational framework and have been implemented since 2009 under several programmes (such as the Securities Markets Programme and the first Covered Bond Purchase Programme). The Eurosystem started large-scale asset purchases under the asset purchase programme launched in October 2014. Since then, the Governing Council expanded the range of assets eligible for purchases. Currently, the so-called expanded asset purchase programme (APP) consists of the third covered bond purchase programme (CBPP3), the asset-backed securities purchase programme (ABSPP), the public sector purchase programme (PSPP) and the corporate sector purchase programme (CSPP).

The APP aims to support the transmission of monetary policy impulses to the financing conditions of the real economy and to provide the amount of policy accommodation needed to ensure price stability. Large-scale asset purchases may affect financial conditions and the macro economy through various channels. First, they raise the prices of assets purchased and lower their yields, thereby easing financing conditions. By purchasing assets central banks can also affect the prices/yields of broadly similar assets, inciting investors to rebalance their portfolio. Large-scale asset purchase programmes also strengthen the central bank’s commitment to keep policy rates low for longer – thereby contributing to lower longer-term interest rates – and underline the central bank’s determination to intervene in disrupted markets, thereby reducing undue volatility in asset prices and providing liquidity in case of need. Large-scale purchases of longer-term assets also lower the private sector’s risk exposure and may foster bank lending by raising the value of securities held by banks as well as by improving the profitability and liquidity of banks. Asset purchases can improve market functioning (e.g. by restoring market liquidity in the presence of significant financial market disruptions and by reviving specific market segments) and affect the economy through the exchange rate.

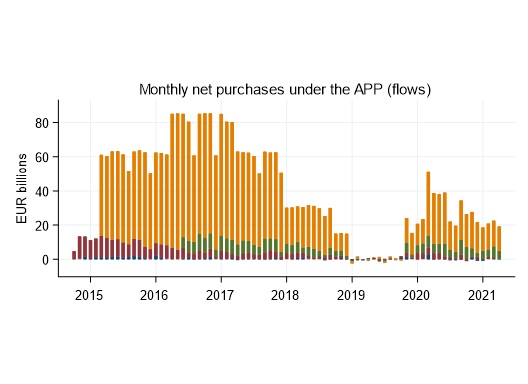

By end-January 2021, the total Eurosystem’s holdings under the APP stood at almost € 3,000 bn. Under the APP, the Eurosystem currently purchases public sector bonds, asset-backed securities, covered bonds and corporate sector bonds at a monthly net pace of € 20 bn. Eurosystem purchases under the APP adhere to the principle of market neutrality via smooth and flexible implementation. PSPP holdings stood at € 2,370 bn in mid-February 2021. Government bonds make up around 90% of the Eurosystem PSPP portfolio, while securities issued by international organisations and multilateral development banks account for around 10%. When implementing the PSPP, the Eurosystem allocates its purchases of public sector bonds such as to align a jurisdiction’s share in the PSPP stock over the medium term as closely as possible with the respective share of the ECB capital key.[7] Under the PSPP, NCBs purchase their respective sovereign bonds, but not bonds of other jurisdictions. 20% of public sector asset purchases under the APP are subject to risk sharing. Purchases of private sector purchases, by contrast, are fully risk shared.[8]

For now, the Governing Council expects net purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates. In addition, the Eurosystem fully reinvests the principal payments from maturing securities held in the APP portfolios. As part of its forward guidance on APP purchases, the Governing Council also intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation. The APP affects the degree of monetary accommodation through flow and stock effects. Flow effects relate to the impact of purchase operations actually conducted (on a net basis, i.e. over and beyond the amount of securities maturing). Stock effects relate to the stock of large-scale asset purchases and typically arise on the announcement of an asset purchase programme or of changes to its key parameters (such as its size, composition and duration).

[1] The fixed rate full allotment procedure replaced variable rate tenders, in which the Eurosystem set the amount of liquidity it intended to provide or withdraw. Back then, counterparties bid both the amount of money they wanted to transact with the Eurosystem and the interest rate at which they wanted to enter into the transaction. The most competitive bids were satisfied with priority until the total amount of liquidity to be provided or to be withdrawn by the Eurosystem was exhausted. Besides the fixed rate full allotment procedure, the Governing Council announced longer-term refinancing operations with 6-month and 12-month maturity, foreign currency operations and a further broadening of the collateral framework.

[2] Some 100 years ago, Silvio Gesell proposed a negative interest rate in the form of a periodic tax on money, which was to be collected via stamps. The idea was taken up by several prominent economists in the 1930s, including Irving Fisher and John Maynard Keynes.

[3] Either in the form of bank notes or coins.

[4] Since June 2014 the interest rate on the Eurosystem’s deposit facility has been negative and stands currently at -0.5%.

[5] Hence, while it has by now become widely acknowledged that there is a lower bound on nominal short-term interest rates in the negative territory, it is notoriously difficult to assess the level of the effective lower bound.

[6] With a view to support the bank-based transmission of the accommodative monetary policy, in October 2019, the Governing Council launched the so-called “two-tier system” for remunerating credit institutions’ excess reserve holdings. Under the two-tier system part of the excess reserves held by credit institutions (i.e. currently six times a credit institution’s minimum reserve requirements, dubbed “allowance”) are exempted from remuneration at the negative rate applicable on the deposit facility and remunerated at 0%. The non-exempt tier of excess liquidity holdings is remunerated at 0% or the deposit facility rate, whichever is lower. The allowance reflecting the role of deposit funding for a bank, the two-tier system supports lending to the real economy in the euro area.

[7] The capital of the ECB comes from the NCBs of all EU Member States and amounts to €10,8 bn. The NCBs’ shares in this capital are calculated using a key which reflects the respective country’s share in the total population and gross domestic product of the EU. These two determinants have equal weighting. The ECB adjusts the shares every five years and whenever there is a change in the number of NCBs that contribute to the ECB’s capital.

[8] Losses on risk-shared assets are split among Eurosystem NCBs according to the capital key.