- European Central Bank publications

4/ The exceptional monetary policy response to the exceptional Covid-19 pandemic

31 May 2021

Blog post by Gaston Reinesch, Governor of the BCL

As an immediate response to the pandemic and its implications for economic and financial conditions the Governing Council launched several additional monetary policy measures. This article briefly describes the main measures taken in the aftermath of the pandemic.[1]

Targeted longer-term refinancing operations (TLTROs III) recalibrated

Announced in March 2019, the TLTRO III programme currently in place consists of a series of operations providing financing to credit institutions, each with a maturity of three years, starting in September 2019 at a quarterly frequency.

TLTROs-III are targeted operations to further incentivise bank lending to the real economy by offering banks long-term funding at very attractive conditions. First, the amount that banks can borrow under TLTROs III is linked to the volume of their lending to non-financial corporations and households (except loans to households for house purchases). Second, the more such loans banks issue, the lower the interest rate on their TLTRO III borrowings becomes.

Following the COVID-19 shock, the Governing Council recalibrated the TLTRO III modalities by lifting the number of operations to ten, raising the amounts banks can borrow and lowering borrowing rates. Currently, borrowing rates in TLTROs III can be as low as 50 basis points below the average interest rate on the deposit facility over the period from 24 June 2020 to 23 June 2022, and as low as the average interest rate on the deposit facility during the rest of the life of the respective TLTRO III.[2]

At the current level of policy rates, under the TLTRO III programmes, banks can borrow at interest rates ranging from -1% to -0.5%, lower than (or equal to) the -0.5% interest rate at which commercial banks can place excess liquidity at their national central bank and hence providing a subsidy to the banking sector. Moreover, as part of the deposits commercial banks hold with their national central bank (“excess reserves”) are exempted from remuneration at the negative deposit facility rate, additional support to the banking system is provided by the two-tier system provides.[3][4]

Pandemic Emergency Purchase Programme (PEPP)

Announced on March 18, 2020 the Pandemic Emergency Purchase Programme (PEPP) has been established in immediate response to a specific, extraordinary and acute economic crisis resulting from the outbreak and the escalating diffusion of the coronavirus (COVID-19). Following the COVID-19 shock economic activity in the euro area contracted sharply and the very high uncertainty put spending plans and their financing at risk. While governments and fiscal policies are the first line of defence, COVID-19 required an ambitious, coordinated and urgent reaction in all policy areas. With COVID-19 hampering the proper transmission of the Governing Council’s monetary policy and adding severe downside risks to the outlook for price stability, the Governing Council is committed to ensuring that all sectors of the economy can benefit from supportive financing conditions.

To this end, in March 2020, the Governing Council announced the PEPP as an additional asset purchase programme. Purchases under the PEPP are conducted with a view to preventing a tightening of financing conditions and to countering the downward impact of the pandemic on the projected path of inflation. All asset categories eligible under the APP are also eligible under the PEPP.[5] While the benchmark allocation of public sector purchases under the PEPP is guided by the ECB capital key, the modalities of the PEPP and its implementation are more flexible. The flexibility of purchases over time, across asset classes and among jurisdictions supports the smooth transmission of monetary policy.

In the course of 2020, the Governing Council decided to increase the initial €750 billion envelope to € 1,350 billion (on June 4, 2020) and to a total of €1,850 billion (December 10, 2020). If favourable financing conditions can be maintained without exhausting the total purchase envelope, that envelope need not be used in full. At the same time, the Governing Council can adjust the envelope if required to maintain favourable financing conditions. Preserving favourable financing conditions helps to reduce uncertainty, supports consumption as well as investment and fosters the economic recovery.

The Governing Council will terminate net asset purchases under the PEPP once it judges that the COVID-19 crisis phase is over, but in any case not before the end of March 2022. The maturing principal payments from securities purchased under the PEPP will be reinvested until at least the end of 2023. In any case, interference with the appropriate monetary stance will be avoided during the future roll-off of the PEPP portfolio.

Pandemic emergency longer-term refinancing operations (PELTROs)

In April 2020 the Governing Council announced a series of so-called pandemic emergency longer-term refinancing operations (PELTROs). The operations provide longer-term funding with maturity between 8 and 16 months to credit institutions against collateral. Unlike TLTROs III, the amount that banks can borrow under PELTROs is not linked to the volume of their lending. PELTROs are offered at highly accommodative terms.

The interest rate is 0.25 percentage points below the average rate applied in the Eurosystem’s main refinancing operations (currently 0%) over the life of the respective PELTRO. By providing liquidity to the euro area financial system, PELTROs ensure smooth money market conditions during the pandemic period.

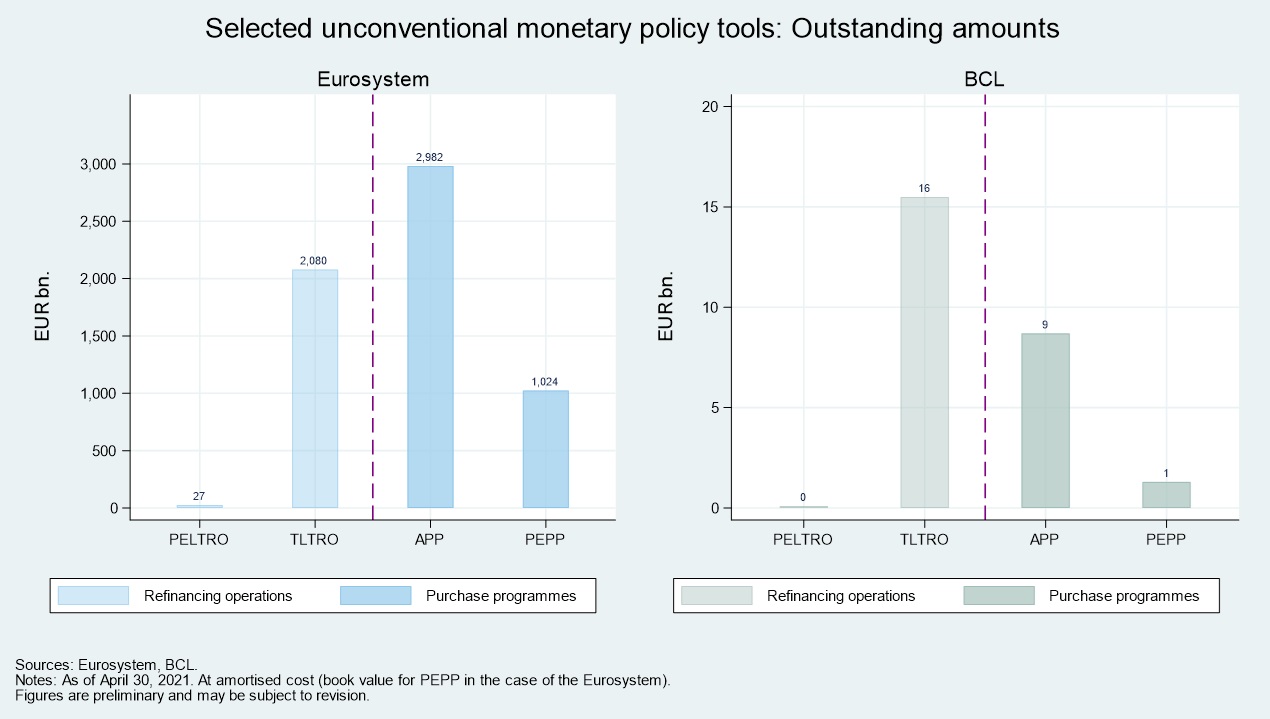

The graph below reports the outstanding amounts of main Eurosystem unconventional monetary policy tools. The objectives, modalities and transmission channels of some of the main unconventional monetary policy tools currently in place will be the subject of upcoming blog articles.

[1] For an overview of the main standard and unconventional monetary policy tools prior to the pandemic please consult [Blog 2 part 1] and [Blog 2 part 2], respectively.

[2] In addition, the Governing Council adopted a package of temporary collateral easing measures to facilitate the availability of eligible collateral for banks to participate in liquidity providing operations, including TLTRO III.

[3] With a view to support the bank-based transmission of the accommodative monetary policy, in October 2019, the Governing Council launched the so-called “two-tier system” for remunerating credit institutions’ excess reserve holdings. Under the two-tier system part of the excess reserves held by credit institutions (i.e. currently six times a credit institution’s minimum reserve requirements, dubbed “allowance”) are exempted from remuneration at the negative rate applicable on the deposit facility and remunerated at 0%. The non-exempt tier of excess liquidity holdings is remunerated at 0% or the deposit facility rate, whichever is lower.

[4] At bank level, the size of the subsidy will depend on the volume of TLTRO III funds borrowed, the date of the recourse to the TLTRO III and balance sheet characteristics (e.g. funding structure).

[5] Within the different asset categories, however, the eligibility requirements under the PEPP are more generous than under the APP (e.g. including securities issued by the Greek Government or non-financial commercial paper). Currently, securities issued/guaranteed by the Greek Government do not fulfil APP eligibility criteria (i.e. a first-best credit assessment from an external credit assessment institution of at least credit quality step 3 for the issuer or the guarantor). Minimum credit quality criteria protect the Eurosystem’s balance sheet and, in the case of public issuers/guarantors, constitute an important safeguard in the context of the prohibition on monetary financing laid down in Article 123 of the Treaty on the Functioning of the European Union (TFEU). The same risk-sharing principles apply for the PEPP as for the APP.