- European Central Bank publications

14/ Residential real estate prices in Luxembourg

21/01/2022

Blog post by Gaston Reinesch, Governor of the BCL

Residential real estate prices in Luxembourg[1]

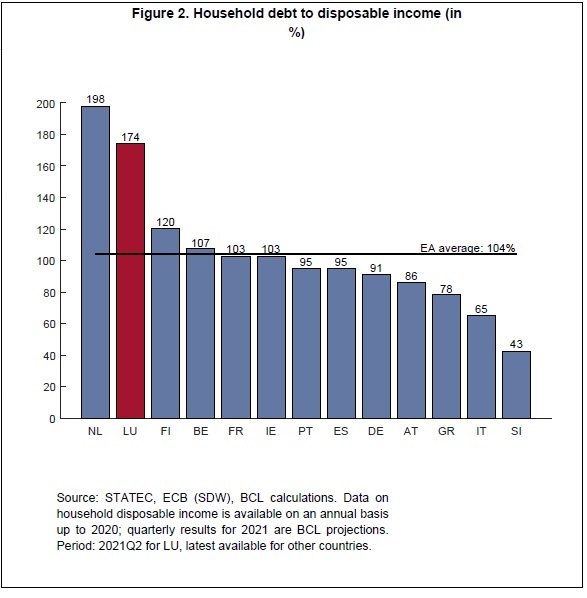

The very rapid rise in residential real estate (RRE) prices in Luxembourg has warranted concern already for a very long time. In nominal terms, RRE prices in Luxembourg have increased on average by 7.5% since 2000 and by 9.7% over the last five years. The corresponding growth rates for the euro area as a whole were lower, at 3.4% and 4.9%, respectively. The continued increases in property prices and mortgage lending in Luxembourg have led to a rising level of household indebtedness. As a result, the ratio of household debt to disposable income more than doubled since 2000 and increased by 10 percentage points over the last five years.[2]

These dynamics, which are mostly explained by structural factors in the Luxembourg housing market, may have also been amplified, especially more recently, by the much needed and decisive monetary policy measures taken in response to the coronavirus (COVID-19) providing crucial support to the economy, maintaining favourable financing conditions and reinforcing the monetary policy stimulus in place already before the pandemic.[3] Nonetheless, while a low interest rate environment supports the borrowing capacity of households, the structural imbalance between housing supply and demand would have persisted in the absence of any accommodative monetary policy. This structural imbalance puts upward pressure on house prices (prices of land and dwellings), thus contributing to an accumulation of a whole range of economic, social, public finance and political problems as well as vulnerabilities in the domestic property market.

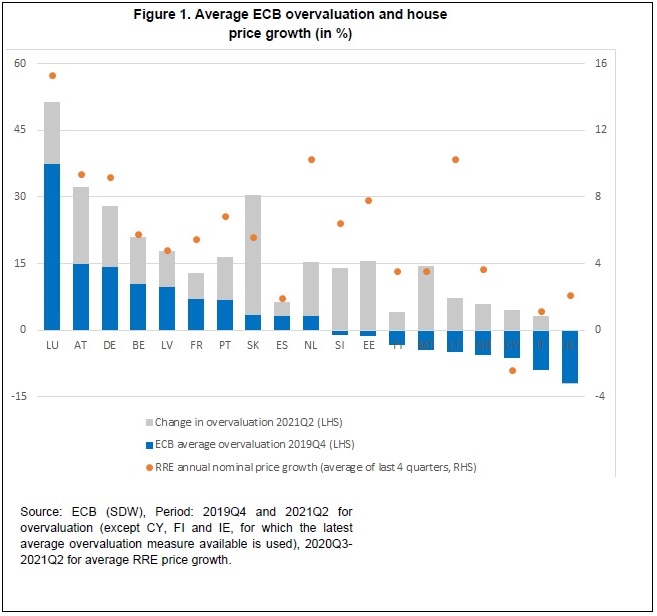

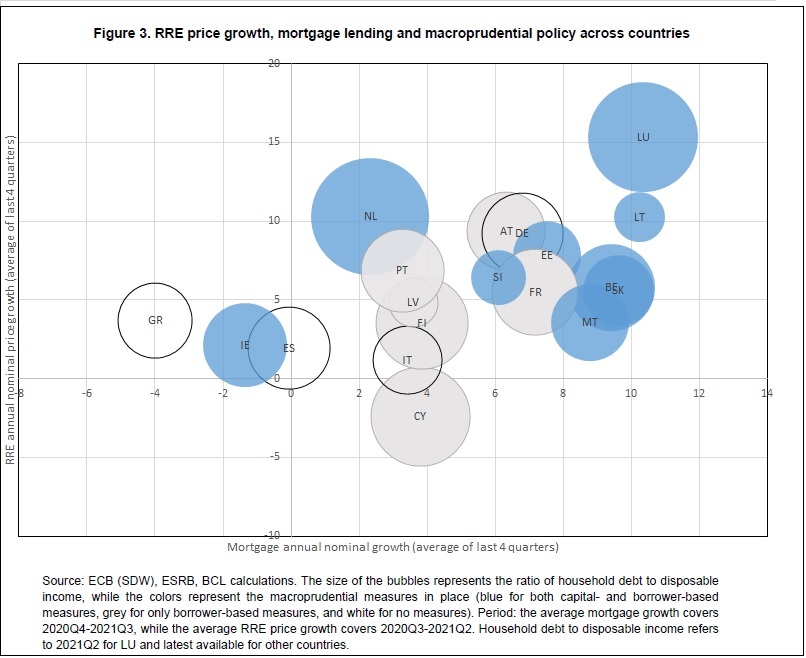

The accumulation of vulnerabilities over the years has led Luxembourg to currently rank among the euro area countries with highest risks in the housing market. Figures 1 to 3 provide cross-country comparisons for a set of relevant indicators.

With property prices in Luxembourg having undergone persistent increases over the last two decades, Figure 1 shows that the recent house price growth has been the highest among euro area countries. Residential dwelling prices in Luxembourg reached a new record-high annual average growth rate of 15.3% in 2021Q2. In line with the recent high house price growth, Figure 1 also shows that the average overvaluation measure estimated by the European Central Bank (ECB) and the European Systemic Risk Board (ESRB) for Luxembourg has increased since 2019Q4 and stood at 51.3% in 2021Q2.

In parallel to the unprecedented surge in house prices since the emergence of the COVID-19 pandemic, mortgage lending has also remained robust. With an average annual increase of 9.7% since 2020Q1, significant mortgage credit growth has led to further increases in the already very high level of household indebtedness. Figure 2 presents the ratio of total household debt to disposable income mentioned above, a standard measure of household indebtedness. In Luxembourg, this indicator is estimated at 174% in 2021Q2, one of the highest values in the euro area.

Figure 3 confirms that, in addition to having the highest annual level of nominal residential real estate price growth and mortgage lending, Luxembourg households are also very highly indebted. In the cross-country comparison of Figure 3, Luxembourg is positioned in the upper right quadrant, corresponding to the highest annual nominal price growth level, as well as the highest annual nominal mortgage growth rate of all euro area countries.

The position of Luxembourg in the cross-country comparisons shown in Figures 1 to 3 suggests important vulnerabilities in the national residential property market. These vulnerabilities are driven by structural factors and to a certain extent have been amplified in the low interest rate environment. At the same time, monetary policy accommodation supports the recent economic recovery and favourable financing conditions, thereby partly cushioning the risks in the short-term. Accordingly, ECB house price-at-risk estimates point to lower near-term risks of a significant downward correction in prices. Lower risks in the near-term should not be misconstrued as an improvement in the overall level of vulnerability, because downside risks remain elevated and are likely to continue to increase in the medium-term.

As shown in Figure 1, developments in RRE prices differ significantly across euro area countries. Not only the growth rate of property prices varies substantially between countries, but also the valuation estimates point to very different degrees of over/undervaluation across euro area countries. The heterogeneity in house price developments suggests that the ECB’s accommodative single monetary policy is not the main driver of house price dynamics in the euro area. If monetary policy was the key determinant of residential property prices, one would expect a more uniform pattern of price growth and valuation estimates across countries.[4] Moreover, despite the accommodative monetary policy conducted over several years, by 2019Q4, the average ECB overvaluation measure was negative in nine euro area countries. Luxembourg standing out as an outlier (as evidenced by price growth and valuation indicators), it appears that the single monetary policy is not the root cause of the current surge in house prices in the country, all the more so because Luxembourg households faced swift increases in house prices already much before interest rates turned negative and prior to the launch of large-scale asset purchases in the euro area.[5]

Whereas the protracted low interest rate environment facilitates debt-taking by households, it has also acted as a mitigating factor to help contain the debt burden (in both nominal and real terms) of households with variable-rate mortgages, at least in the short-term. Therefore, while the sensitivity of house prices to the interest rate level cannot be excluded, effects on funding costs related to the low interest rate environment are expected to be benign in comparison to structural factors.

It is mainly structural factors that have exerted a significant impact on house price dynamics in Luxembourg over the last two decades, in particular by restricting housing supply and resulting in acute housing shortage. Between 2001 and 2018, while the population increased by almost 175,000, the number of dwellings constructed was approximately 53,000.[6] [7] In an environment where the supply of housing is constrained, various policy measures focusing on reinforcing the demand for property[8] tended to fuel the prices of plots and dwellings and then, economically speaking, had a negative distribution effect.

The RRE analyses conducted by both the ECB and the ESRB also suggest structural factors had a sizable effect on house price overvaluation after controlling for domestic economic fundamentals. Taking into account statistical indicators and model-based results, the average ECB-ESRB overvaluation measure for Luxembourg was estimated at 51.3% in 2021Q2, the highest value in the euro area as shown in Figure 1. However, it is worth noting that there is some degree of uncertainty surrounding overvaluation estimates.[9] As the results might be influenced by model specifications and parameters uncertainty, overvaluation measures should be understood against such model caveats.

House price growth persistence at such high rates as the ones observed in Luxembourg is unsustainable and poses real challenges for the domestic economy and policy-makers. According to the ESRB’s recent report on RRE vulnerabilities in the EU, and despite the measures that have been already implemented in Luxembourg, the high risks suggest a need for an encompassing and coordinated policy action package as no single policy option is sufficient to address the diverse economic, social, budgetary, and macroprudential policy challenges inherent to the risks.

Structural factors have played a prominent role, as the demand for residential dwellings has outstripped supply over a prolonged period, resulting in a persistent structural imbalance. The high level of household debt is a significant risk for the real economy, especially against the background of the adverse impact of the coronavirus pandemic on income and employment. As stressed before, an effective remedy will require a coordinated policy action. In a context of strong housing demand increasing the supply of constructible land and dwellings, including social and affordable housing, and ensuring a competitive construction sector would help to alleviate market constraints and shortage of plots and dwellings over the medium-term. They are also key in ensuring access to home ownership for the population at large and in avoiding dividing the population into “insiders” and “outsiders”. Reviewing the spatial planning policy would allow for a more efficient land-use across the territory (the price of constructible land is a key cost). Refining the taxation policy on vacant land and unoccupied dwellings - focusing on maximizing the steering and incentive effects rather than tax revenues - would discourage land hoarding and create incentives to increase housing development. Such concerted policy actions favouring constructible housing supply are critical to curb the structural factors that drove and are driving the economic, social, public finance and political problems as well as the housing vulnerabilities in Luxembourg. Moreover, measures aiming to align housing supply and demand need to be part and parcel of a broader infrastructure policy strategy at national, regional and local level (including education and transport), accounting also for considerations related to economic and environmental sustainability.

____________________________

[1] I would like to thank Sara Ferreira Filipe, Patrick Lünnemann and Abdelaziz Rouabah for their support in preparing this article.

[2] Hereafter, figures for household debt to disposable income refer to gross debt (i.e. not adjusted for assets held), as usual.

[3] See also the blog article “The exceptional monetary policy response to the exceptional COVID-19 pandemic” and footnote six of the blog article “Public sector asset purchases, including of Luxembourg government bonds by BCL, under the PSPP and the PEPP”.

This blog does not address the implications of the high inflation rates recorded in the second half of 2021, as well as the inflation rates projected for the coming years, for the need to normalise monetary policy.

[4] It is widely acknowledged that house price dynamics also differ markedly within countries, again suggesting that the single monetary policy is not the main driver of house prices.

[5] Furthermore, the Governing Council undertook measures with a view to mitigate unintended side effects of the accommodative monetary policy. For instance, when determining the modalities of the three series of targeted longer-term refinancing operations announced in June 2014 (TLTRO), March 2016 (TLTRO II) and March 2019 (TLTRO III), the Governing Council deliberately excluded loans to households for house purchase, with a view to avoid excessive house price growth and excessive mortgage lending.

[6] Source: Statec.

[7] According to the Statec, the average household size in Luxembourg was 2.41 persons in 2010. On average, much larger households would have been required to make the number of dwellings constructed commensurate with the observed rise in population.

[8] Including individual aids, tax credits (“Bëllegen Akt”), the reduced VAT rate and other tax incentives (e.g. related to contributions to homebuyer savings plans and mortgage interest expenses).

[9] The average ECB-ESRB overvaluation measure reported in Figure 1 reports the mean of four valuation measures, including statistical indicators (i.e. price-to-rent ratio and price-to-income ratio) and model-based results. Model-based estimates after controlling for economic fundamentals often suggest a much lower degree of overvaluation of RRE prices in Luxembourg than plain statistical metrics. For a summary of the estimates of house price valuation in Luxembourg derived from an econometric model, please refer to Box 1.1 of the 2021 BCL Financial stability review <link>.