- European Central Bank publications

2/ An overview of the main Eurosystem’s monetary policy instruments in place

6 April 2021

Blog post by Gaston Reinesch, Governor of the BCL

The previous blog article (How does the Governing Council take monetary policy decisions?) described how the Governing Council takes monetary policy decisions. This post serves as a prelude to a series of altogether three articles describing the instruments through which the Eurosystem implements monetary policy decisions.

To this end, this first post (1. Conventional monetary policy tools) will recapitulate the conventional monetary policy tools that were the main instruments used by the Eurosystem before the global financial crisis of 2007-2008.

The subsequent two posts (2. Unconventional monetary policy tools adopted before 2020 and 3. Monetary policy response to the Covid-19 pandemic) will then focus on unconventional monetary policy tools adopted since 2009.

PART 1: CONVENTIONAL MONETARY POLICY TOOLS

The primary objective of the European System of Central Banks (ESCB)[1] is to maintain price stability and, without prejudice to the objective of price stability, to support the general economic policies in the EU[2]. The Governing Council determines the monetary policy stance required to maintain price stability over the medium term on the basis of the monetary policy strategy. The set of instruments and procedures used to achieve the desired monetary policy stance, in turn, is determined by the operational framework.

The Eurosystem’s operational framework is founded on a number of guiding principles. Among the key principles are efficiency and decentralisation of monetary policy implementation. Other important principles are equal treatment of financial institutions, the harmonisation of rules and procedures throughout the euro area, simplicity, transparency, continuity and safety. Furthermore, to ensure the efficient transmission of monetary policy to the real economy and prices, the operational framework has to be consistent with the principles of a market-oriented economy in which competition is key to ensuring an efficient allocation of resources (Article 127 TFEU).

From the inception of the ECB, the Eurosystem’s operational framework featured a wide range of conventional monetary policy tools, including open market operations, the minimum reserve system and standing facilities.

Prior to the global financial crisis, the Eurosystem’s main regular open market operations consisted of short-term main refinancing operations as well as three-month longer-term refinancing operations. These operations provided liquidity to the euro area banking system such that banks can satisfy the demand for currency by the public, to clear interbank balances or to fulfil the requirements for minimum reserves they must keep with their national central bank (NCB) (see following paragraph).

Open-market operations provided credit institutions for a limited, pre-specified period against assets pledged as collateral. Prior to the global financial crisis, main refinancing operations were the most important open market operations and represented the key monetary policy instrument of the Eurosystem. By setting the interest rate on its main refinancing operations (i.e. the rate at which banks can borrow funds from the Eurosystem against collateral), the Governing Council could steer the level of short-term interest rates and by affecting banks’ funding costs of liquidity shaped financing conditions in the economy more broadly which, in turn, affected spending decisions of companies and households and ultimately output and inflation in the euro area.

The minimum reserve system requires euro area credit institutions to hold deposits on accounts with NCB. In principle, the amount of required reserves to be held by each institution is determined multiplying elements of its balance sheet (reserve base) by so-called reserve ratios.[3] Required reserves are remunerated at the average interest rate on main refinancing operations (currently at 0%). Before the global financial crisis, the minimum reserve system had two main functions, namely to facilitate the Eurosystem’s steering of interest rates through regular liquidity providing operations (by increasing the demand for central bank credit) and to stabilise money market interest rates. The minimum reserve system stabilises money market interest rates through the so-called “averaging provision”. Under that provision, a given bank’s compliance with reserve requirements is determined on the basis of the average of the daily balances on its reserve accounts over the maintenance period. The averaging provision allows banks to smooth out daily liquidity fluctuations, thereby stabilising the overnight interest rate during the maintenance period and rendering frequent Eurosystem interventions in the money market unnecessary.

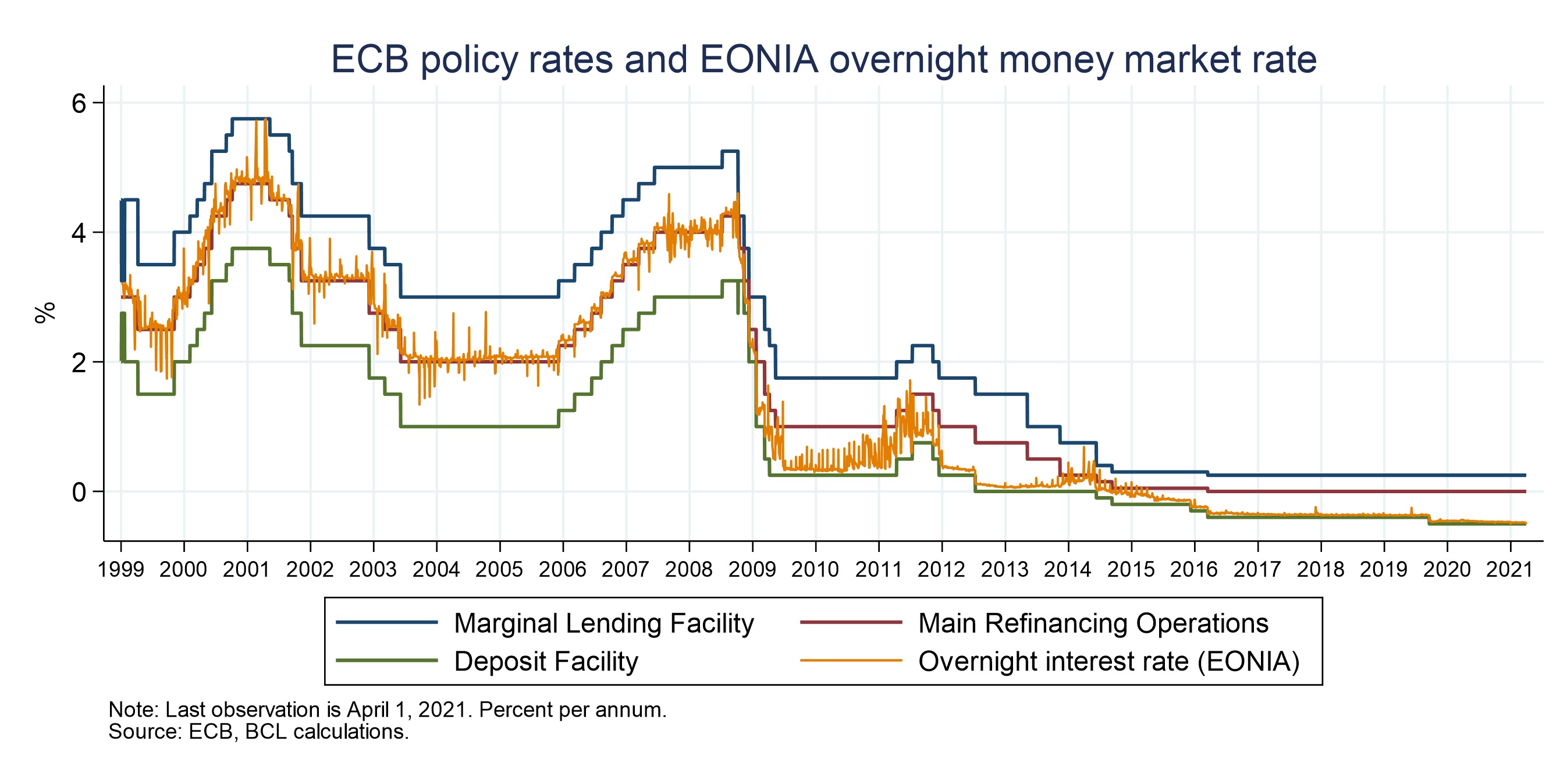

Two types of standing facilities are available to euro area banks at their discretion (in the absence of market alternatives, for instance), the marginal lending facility (to obtain overnight liquidity from the Eurosystem against collateral) and the deposit facility (to make overnight deposits with the Eurosystem). Prior to the global financial crisis, the interest rate on the marginal lending facility provided a ceiling for the overnight interest rate in the interbank money market while the interest rate on the deposit facility provided a floor for the overnight interest rate.

Before the global financial crisis, this “corridor” spanned by the interest rates on the standing facilities was set most of the time symmetrically around the main refinancing operations rate with a width of 200 basis points.

The Eurosystem was providing the aggregate amount of liquidity that the banking system needed and banks were efficiently managing their liquidity needs so that excess liquidity was zero on average. As a result, the overnight interest rate in the interbank market (EONIA[4]) was very close to the main refinancing operations rate, as shown in the figure below.[5]

With the onset of the global financial crisis, stress in the money markets led the Eurosystem to supply ample liquidity to banks, creating large excess liquidity by allotting liquidity using the fixed rate full allotment tender procedure. Contrary to the pre-crisis practice, under fixed rate full allotment, and subject to adequate collateral, euro area banks have unlimited access to Eurosystem liquidity at the main refinancing rate. Arbitrage in the interbank market then implied that the overnight interest rate declined towards the deposit facility rate.

Prior to the global financial crisis, the above main conventional monetary policy tools were used to keep inflation in the euro area in line with the Governing Council’s definition of price stability (i.e. annual inflation of below, but close to, 2% over the medium term). Facing too low inflation in the aftermath of the global financial and sovereign debt crises, the Governing Council lowered interest rates to ease financing conditions. But once interest rates reach very low levels, it is more difficult for central banks to add monetary stimulus. Moreover, if the monetary transmission mechanism gets clogged, conventional monetary policy tools may be insufficient to properly transmit monetary policy impulses to the real economy. Since 2009 the Governing Council therefore implemented several unconventional monetary policy tools that will be covered in the following two articles.

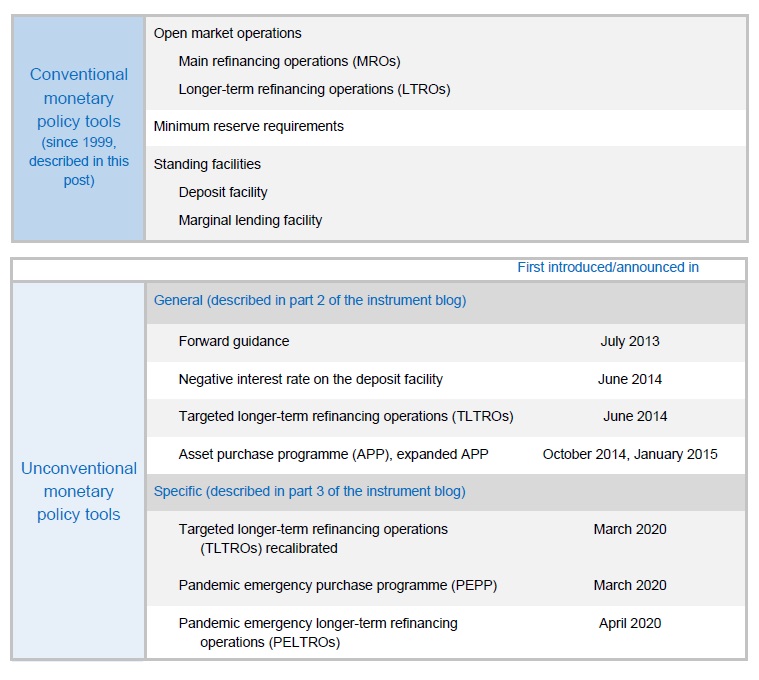

The following table summarizes the conventional as well as the unconventional tools dealt with in the two following articles.

Principal conventional and unconventional Eurosystem monetary policy tools currently in operation

[1] The ESCB consists of the ECB and the national central banks (NCBs) of all member states of the EU.

[2] (Article 127(1) of the Treaty on the Functioning of the European Union (TFEU))

[3] Since January 2012, a reserve ratio of 1% is applied to overnight deposits, deposits with an agreed maturity or period of notice up to 2 years, debt securities issued with an original maturity up to 2 years and money market paper (previously that reserve ratio stood at 2%). A reserve ratio of 0% is applied to deposits with an agreed maturity over two years, deposits redeemable at notice over two years, repurchase agreements and debt securities issued with an original maturity over two years. In order to reduce the administrative burden arising from managing very small reserve requirements, since the introduction of the euro credit institutions are entitled to deduct a uniform lump-sum allowance of €100,000 from their reserve requirement.

[4] EONIA - an interbank overnight reference rate for the euro published by the European Money Markets Institute (EMMI) - will be discontinued in January 2022, given the lack of underlying transactions and high concentration of volumes by a few contributors. EONIA will be replaced by €STR, a short-term rate reflecting the wholesale euro unsecured overnight borrowing costs of euro area banks published by the ECB since October 2019.

[5] The averaging provision contributes to stabilising the overnight interest rate during the maintenance period. With the (average) reserve requirement becoming binding at the end of the maintenance period, however, banks are no longer in a position to carry-over a liquidity surplus or deficit into the future and EONIA could deviate temporarily from the interest rate on the main refinancing operations (as shown in the graph).