- European Central Bank publications

9/ The new monetary policy strategy of the Eurosystem

6 August 2021

Blog post by Gaston Reinesch, Governor of the BCL

THE NEW MONETARY POLICY STRATEGY OF THE EUROSYSTEM[1]

Based on a thorough monetary policy strategy review launched in January 2020, on July 7, 2021 the ECB’s Governing Council decided on a new monetary policy strategy, announced on July 8, 2021. This blog article reviews the motivation for the monetary policy strategy review by the Eurosystem and one of its key outcomes, the medium-term inflation target. Other elements of the new strategy will be the subject of forthcoming articles.

REASONS FOR A NEW STRATEGY

The main elements of the monetary policy strategy[2] of the ECB were decided by the Governing Council in 1998 and reviewed in 2003. It consisted of three main elements: a quantitative definition of price stability, a comprehensive analysis of the risks to price stability and a medium-term orientation of monetary policy.

The way the economy works has changed since 2003 and many of these changes have profound implications for the conduct of monetary policy. The major economies became much more integrated, globalisation and digitalisation increased competition among companies. The increasing role of financial services provided outside of the banking system may affect the transmission of monetary policy to the wider economy. Population ageing implies that the share of pensioners increases, which might increase government spending and borrowing. Similarly, as people expect to live longer, they also save more. Both factors can affect interest rates at the same time as monetary policy. Climate change can affect monetary policy via higher uncertainty about future economic developments and policies addressing climate change may affect price developments.

Some of these developments have contributed to a decline in equilibrium real interest rates, i.e. the real rate of interest consistent with macroeconomic balance over the long run, both in the euro area and across the globe (see for instance Kiley, 2019). Equilibrium real interest rates are not directly observable. They must be estimated and the estimations, which are also model-dependent, are subject to very high uncertainty. There is, however, a broad consensus that they have declined (see e.g. Brand et al., 2018). All else equal, the decline in the equilibrium real rate limits conventional interest rate policy in case of disinflationary shocks as the room to lower the level of real interest rates through cuts in nominal interest rates is reduced. All else equal, it also implies that monetary policy will more often reach the effective lower bound on nominal interest rates[3], requiring deploying policy instruments other than standard policy rates.

In addition, the institutional framework in which the Eurosystem operates has changed, even though it still remains incomplete (as evidenced, for instance, by the incomplete capital markets and banking union and the absence of a pan-European fiscal stabilization function). Furthermore, the communication landscape has evolved as the role of traditional media (i.e. printed press and television) declined and social media – for the good and sometimes for the bad – play an increasing role. The strategy review provided an opportunity to tailor the Eurosystem’s communication to the new situation with the aim to reach a broader audience.

Overall, the aim of the ECB's strategy review was to make sure that ECB’s monetary policy strategy is fit for purpose, both today and in a near future.

INFLATION TARGET

As indicated at the launch of the ECB’s monetary policy strategy review announced in January 2020, the review took the ECB’s mandate as enshrined in the EU Treaties as given. Article 127(1) of the Treaty on the Functioning of the European Union (TFEU) states that the primary objective of the European System of Central Banks (ESCB)[4] shall be to maintain price stability.

In order to specify the primary objective of price stability, in 1998, the Governing Council of the ECB had announced the following quantitative definition: “Price stability shall be defined as a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%. Price stability is to be maintained over the medium term”.

Following a thorough evaluation of its monetary policy strategy in 2003, the Governing Council had further clarified that, within that definition, it operationally aimed to maintain inflation rates “below, but close to, 2% over the medium term” (also known as the “double key formulation of the price stability objective”).

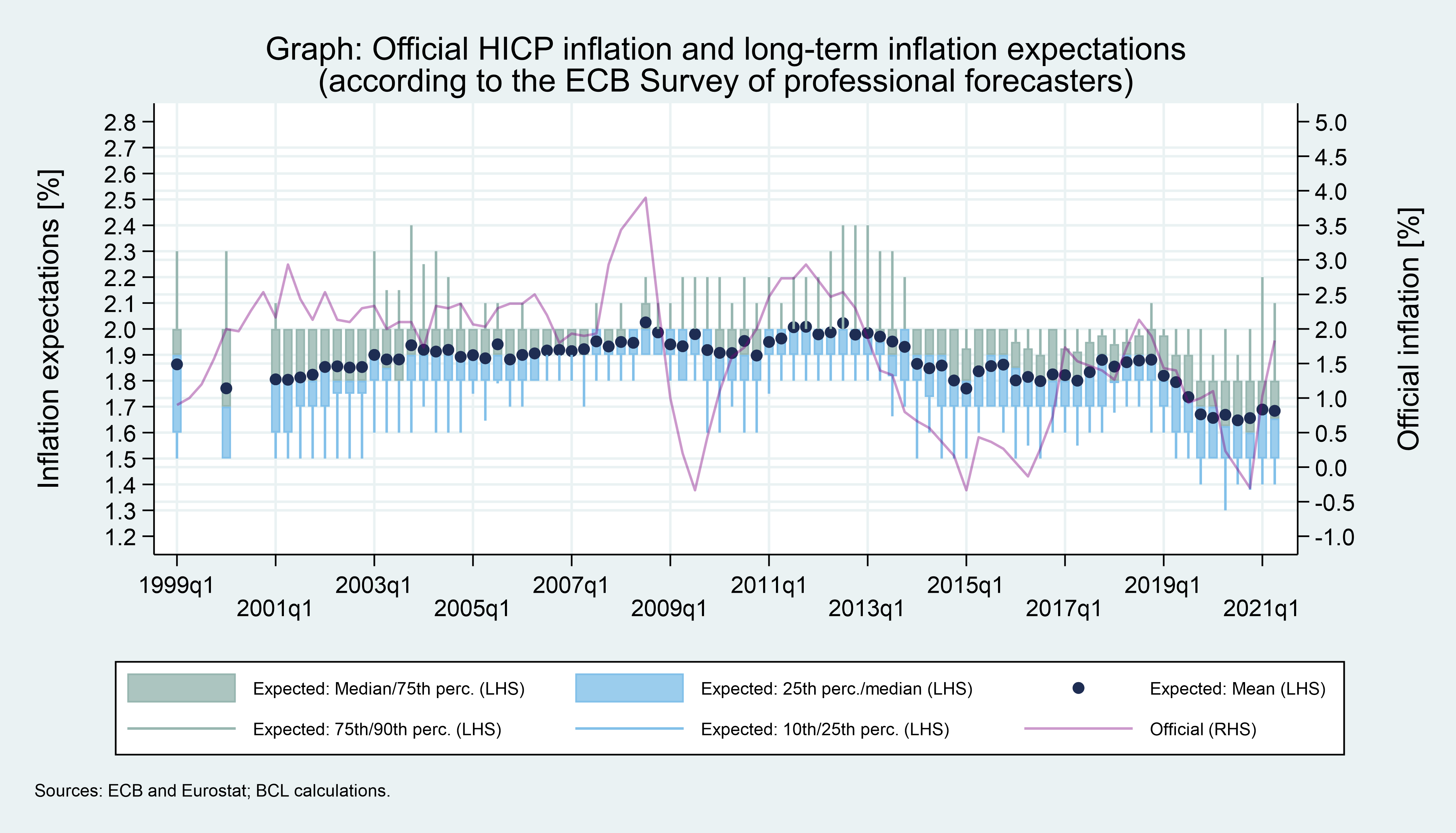

The double key formulation provided a yardstick for the ECB’s accountability at a time when the Governing Council had to rapidly establish its credibility for maintaining price stability. It also helped to achieve price stability by anchoring inflation expectations of economic agents in a context where cost-push shocks repeatedly implied upside risks to price stability (see the graph below).

However, over the last decade the euro area witnessed a shift towards disinflationary shocks reflecting cyclical drivers (e.g. the disinflationary impact of the 2009 and the 2012 recessions) and structural trends (e.g. digitalisation, globalisation and demographic factors). These shocks underlined the need to solidly anchor inflation expectations around the inflation aim not only in the event of sustained upside risks to price stability, but also when facing risks of a persistent inflation shortfall. In the face of sustained disinflationary shocks the double key formulation (where the asymmetric inflation objective was close to the upper end of the price stability range) might have led to a perceived ambiguity about the level of inflation aimed at and asymmetry of the Governing Council’s reaction function.

Against this background, at this juncture, the Governing Council considers that price stability is best maintained by aiming for a clear and symmetric two per cent inflation target over the medium term.

The new two per cent inflation medium-term target not only is an important cornerstone of the new strategy. It also marks a major change from the previous strategy under which the ECB’s mandate had deliberately been formulated in terms of a price stability objective rather than an inflation target.[5]

The new target is simple, clear and easy to communicate. Importantly, the new two per cent inflation target is clearly symmetric[6], with the Governing Council considering negative and positive deviations of inflation from the target to be equally undesirable. Temporary and moderate fluctuations of inflation both above and below the medium-term target of two per cent are unavoidable and, per se, unproblematic.

By contrast, large, sustained deviations from the inflation target, whether to the upside or to the downside, can destabilise longer-term inflation expectations. More forceful and persistent monetary policy action is required in the face of significant deviations from the target which are expected not to be transitory. This applies specifically to disinflationary shocks in direction of the effective lower bound. By anchoring the commitment to symmetry explicitly in the new strategic framework the Governing Council removed any remaining perception of ambiguity in its aspirations. The two per cent inflation medium term target provides a clear anchor for longer-term inflation expectations going forward, which is essential to the maintenance of price stability.

As mentioned, the two per cent medium term inflation target also underlines the ECB's commitment to providing an adequate inflation buffer over the medium term, thereby mitigating the risk of deflation and protecting the effectiveness of monetary policy in responding to disinflationary shocks. The available policy space in terms of nominal interest rates is jointly determined by the level of the equilibrium real interest rate and the level of the inflation target. All else equal, the decline in the equilibrium real interest rate witnessed since the previous strategy review conducted in 2003, which reduces the available policy space in the face of disinflationary shocks and increases the prevalence and duration of lower bound episodes.[7]

On balance, the new target implies that the nominal interest rate is sufficiently far from the effective lower bound..[8] Model simulations show that an inflation target of two per cent allows to stabilise the average level of inflation over the long run at the target and to limit the volatility of inflation. It limits the frequency of hitting the lower bound on the one hand and mitigates the welfare costs of higher inflation on the other hand.

The main other outcomes of the 2020/21 strategy review, related to the measurement of inflation, the costs of owner-occupied housing, the medium-term orientation of the ECB’s monetary policy, the monetary policy instruments, the new integrated analytical framework, a reinforced proportionality assessment, a “greening” of monetary policy and the Eurosystem’s communication, will be the subject of forthcoming blog articles.

[1] I would like to thank P. Lünnemann and L. Wintr for their support in preparing this article.

[2] Within the mandate provided by the EU Treaties, the monetary policy strategy is devised by the ECB’s Governing Council and specifies how to achieve the primary objective of maintaining price stability in the euro area.

[3] As discussed in one of the previous blog articles on unconventional monetary policy tools, the extent to which central banks can lower interest rates is limited by the effective lower bound on nominal interest rates. First, as interest rates on deposits decline, the negative yield will at some point exceed the cost of storing physical cash, potentially triggering a move from deposits (held by commercial banks with the central bank and/or held by businesses and households with their commercial bank) to cash holdings. Second, if banks cannot fully pass the cost of negative interest rates (applied to their deposits with the central bank) to deposits held by their customers (e.g. businesses and households), they might increase their lending rates to remain profitable, hence countering the desired expansionary effect of lower rates.

[4] The ESCB comprises the ECB and the National central banks of all EU Member States [Article 282(1) of the TFEU].

[5] A published numerical inflation target – next to a predefined horizon – is typically part of a direct inflation targeting strategy. Back in the early 2000s the Governing Council’s choice of a price stability definition (rather than an inflation target), it was claimed, helped policy-makers to avoid mechanistic reactions in response to shorter-term developments aimed at restoring the inflation target at a fixed short-term policy horizon. The global financial crisis underlined the need to account for factors that may affect inflation over and beyond the standard horizon of an inflation target, leading to more flexible inflation targets.

[6] The 2% are no more a ceiling.

[7] At the same time, the new monetary policy tools deployed by the Governing Council permitted to partially overcome the constraints posed by the lower bound.

[8] An inflation buffer also allows for the presence of a small positive measurement bias in the HICP (i.e. the measured inflation rate slightly overstates the “true” inflation rate). It also reduces the risk of an excessive rise in unemployment in the event of a macroeconomic downturn and in the presence of downward nominal rigidities (e.g. when nominal wages cannot be cut). Finally, a sufficient inflation buffer facilitates the adjustment of imbalances across regions, avoiding persistently negative inflation in single euro area countries.