- Publications de la Banque centrale européenne

30/ The ECB Governing Council’s 2025 monetary policy strategy assessment

19/11/2025

Blog post by Gaston Reinesch, Governor of the BCL

The ECB Governing Council’s 2025 monetary policy strategy assessment[1]

1. Introduction

The ECB’s monetary policy strategy sets out how to achieve the primary objective of maintaining price stability in the euro area as well as how to take into account other considerations without prejudice to price stability.[2]

When concluding its strategy review in July 2021, the ECB Governing Council announced its intention to assess periodically the appropriateness of its monetary policy strategy, with the next assessment expected in 2025. Changes that occurred to the economic and financial environment as well as the policy challenges since then warranted an update.

On 30 June 2025, based on an extensive collaborative effort involving staff of the ECB and national central banks across the euro area, the Governing Council published the outcome of the 2025 assessment of the ECB monetary policy strategy.

2. Changes in the economic environment since the 2021 strategy review

The 2021 strategy review had been conducted against the backdrop of a long period of too low inflation[3], reflecting the impact of major shocks, such as the global financial and sovereign debt crises as well as the COVID-19 pandemic, and cyclical drivers (recessions in 2009 and 2012) interacting with structural trends (e.g. globalisation, digitalisation and demographics).

At the same time, although notoriously subject to high uncertainty, estimates of the equilibrium real interest rate – the interest rate consistent with inflation at its target and the economy operating at its potential – had declined, owing to among others declining productivity growth, population ageing and persistently higher demand for safe and liquid assets.

The persistently low inflation and lower equilibrium real interest rate had reduced the space available for monetary easing by conventional interest rate policy and led to an unprecedented recourse to unconventional measures (e.g. targeted longer-term refinancing operations, forward guidance, negative policy rates and large-scale asset purchases). These measures contributed to mitigating disinflationary pressures, dispelling deflation concerns and averting a more pronounced downward drift in inflation expectations.

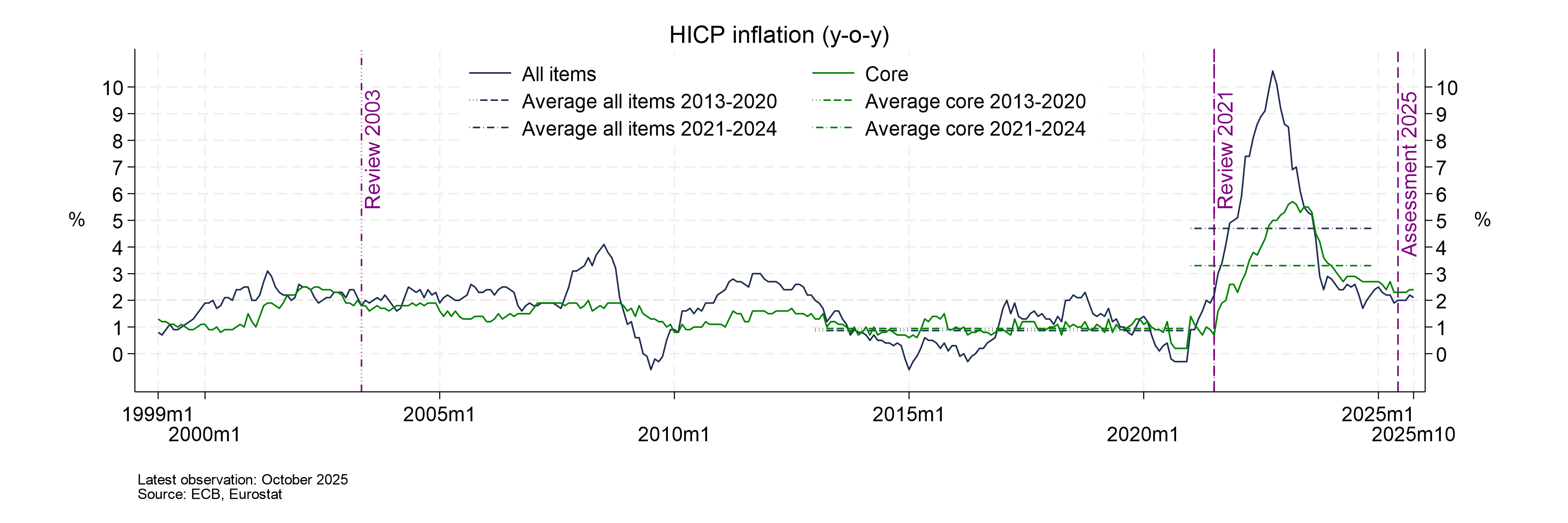

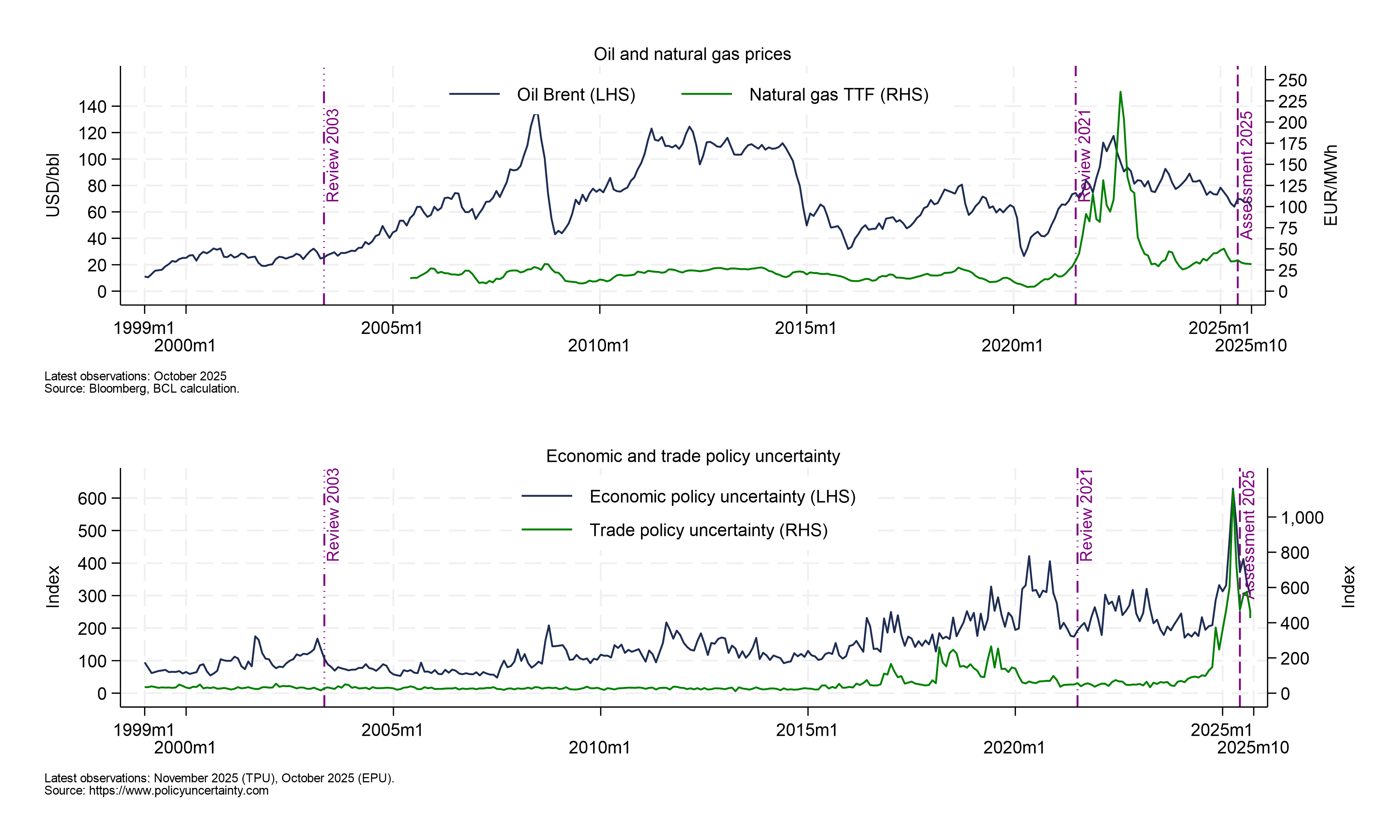

Following the conclusion of the 2021 strategy review, by contrast, the euro area faced a series of extraordinary shocks (triggered, among others, by the COVID-19 pandemic and Russia’s unjustified war against Ukraine) pushing inflation up to levels not seen since the inception of the ECB (top panel of Graph 1 below).

Energy, food and supply chain shocks played an especially important role for the initial inflation surge (middle panel of Graph 1 below), followed by an unusually strong pass-through to consumer prices. Tight labour markets, higher short-term inflation expectations and the unwinding of fiscal policy measures intended to smooth the inflationary effects of the energy price shock contributed to more persistent Inflationary pressures.

Graph 1: Exceptional economic developments since the 2021 strategy review

Moreover, the recent past saw an exceptional increase in policy uncertainty, reflecting geopolitical shifts towards fragmentation of global production and trade networks, as well as threats to Europe’s security (bottom panel of Graph 1 above).

Going forward, ongoing structural shifts and more frequent adverse supply-driven shocks, related to geopolitical factors or climate change for instance, may contribute to higher economic uncertainty and potentially higher inflation volatility. In addition, the set of structural factors affecting the persistent component of inflation are now more two-sided than at the time of the 2021 strategy review. The prospect of more frequent and/or larger deviations, in both directions, of inflation from the medium-term target bears potentially important implications for the monetary policy strategy.

The thorough strategy assessment, backed by comprehensive Eurosystem staff analyses, suggests that, overall, the strategy announced following the 2021 review served the Governing Council well in responding flexibly to the shocks that emerged since then. While confirming key elements of its strategy (see section III of this blog post), the Governing Council also updated others in the light of the insights gained since the 2021 review (see section IV).

3. Unchanged elements of the monetary policy strategy

Price measurement

While the ECB’s primary objective of price stability is enshrined in Article 127(1) of the TFEU, the Treaty does not provide a definition of price stability. As part of its monetary policy strategy, already in 1998, the Governing Council defined price stability in terms of the Harmonised Index of Consumer Prices (HICP) for the euro area.

Owing to the timeliness, reliability, comparability over time and across countries and credibility of the HICP, the Governing Council considers the headline HICP to remain the appropriate price measure for assessing the achievement of the price stability objective for the euro area.

That said, the Governing Council will continue to monitor a wide set of price indicators, including measures of underlying inflation that exclude certain volatile components. Such measures can provide supplementary information about the drivers of price developments and how inflation is likely to evolve over the medium-term.

As pointed out when concluding the 2021 strategy review, in order to further enhance the representativeness of the HICP and its cross-country comparability, the Governing Council considers that the inclusion in the HICP of the costs related to owner-occupied housing would better represent the inflation rate that is relevant for households.

Medium-term orientation

The strategy assessment confirms the medium-term orientation of the Governing Council’s monetary policy. The medium-term orientation acknowledges the unavoidable short-term deviations of inflation from target in part due to variable and uncertain lags in the transmission of monetary policy to inflation. It provides flexibility to tailor policy responses to the specific shock hitting the economy. Without prejudice to the primary objective of price stability, the medium-term orientation allows the Governing Council to incorporate in its policy decisions other considerations relevant for price stability (such as employment, financial stability or climate change).

The 2025 strategy assessment reviewed various mechanisms that might affect the desirability/ability of “looking through” economic shocks. On the one hand, de-anchoring risks and non-linearities in the price-setting process that make monetary policy more effective weaken the looking-through argument. On the other hand, hysteresis or financial stability side effects linked to tighter monetary policy strengthen the case for looking through temporary shocks as long as inflation expectations remain well anchored.

Integrated analytical framework

The Governing Council continues to base its monetary policy decisions on an integrated analytical framework that covers all relevant factors. The integrated analytical framework includes (i) the economic analysis focusing on real and nominal economic developments and (ii) the monetary and financial analysis examining monetary and financial indicators, with a focus on the functioning of the monetary policy transmission mechanism and the interactions between monetary policy and financial stability. Reflecting the uncertain and volatile environment witnessed in recent years, the Eurosystem staff enhanced the analysis of risks and uncertainty surrounding the economic projections (see sub-section “Policymaking under high uncertainty, volatility and lower predictability” below).

Communication

Clear communication of monetary policy decisions and their rationale improves the effectiveness of monetary policy and is tailored to the changing communication and economic environment (see sub-section “Policymaking under high uncertainty, volatility and lower predictability” below). A periodical assessment of the monetary policy strategy ensures that the monetary policy strategy remains fit for purpose. The next strategy assessment is expected in 2030.

4. Updates of the monetary policy strategy

Policymaking under high uncertainty, volatility and lower predictability

The 2021 strategy review made references to uncertainty mainly in the context of the effective lower bound. It did not provide much guidance on how to systematically incorporate uncertainty in policymaking though. As uncertainty has been ubiquitous since 2021 and is expected to prevail at least in the near term (see section II), the analytical framework used to assess the implications of uncertainty for monetary policy has been enhanced.[4]

Since 2021, the Eurosystem made extensive use of “narrative” scenarios (such as the impact of trade tariffs or the Russian aggression in Ukraine) and alternative technical projection assumptions (e.g. on oil prices or exchange rates).

Moreover, the Governing Council adapted its decision-making and communication in the face of high uncertainty and lower predictability since 2021, moving away from unconditional commitments over extended periods of time that were used to steer market expectations during the low inflation period. Instead, the Governing Council emphasized the value of flexibility and state-dependence while relying on data-dependent interest rate decisions on a meeting-by-meeting basis.

Relying on several indicators rather than putting a high weight on a single one, too, can lower the risk of policy mistakes in a situation when different indicators point in different directions and/or macroeconomic projections are subject to high uncertainty. Since March 2023, the Governing Council steered the monetary policy stance based on a three-element reaction function, including (i) its assessment of the inflation outlook, (ii) the dynamics of underlying inflation and (iii) the strength of monetary transmission. The dynamics of underlying inflation provide important indications of the inflation trend based on observed data, complementing the information provided by forecasts. In addition, for a given inflation path, assessing the strength of monetary transmission indicates how the policy impulse is being passed on through the transmission chain. As the economy and the level of uncertainty evolve over time, the importance and interpretation of each element might change. While the three elements guide the Governing Council’s monetary policy decisions, the three-element “reaction function” should not be interpreted as a mechanical prescription determining the interest rate path. Nor does it constitute a precommitment to a specific interest rate path.

Strengthening the 2 per cent symmetric inflation target through forceful or persistent monetary policy action in response to large, sustained deviations from target in either direction

Following the 2021 strategy review, the Governing Council concluded that maintaining price stability can best be achieved by aiming for an unambiguous and symmetric 2 per cent medium-term inflation target.

The symmetric inflation target replaced the double-key formulation of the price stability definition adopted in 2003[5] signalling that the Governing Council considers negative and positive deviations of inflation from the target to be equally undesirable. Based on the 2025 strategy assessment, the Governing Council confirmed the symmetric 2 per cent inflation target over the medium term.[6]

Moreover, the Governing Council strengthened the medium-term target by emphasizing its full symmetry. The 2021 monetary policy strategy statement called for “especially forceful or persistent” action close to the effective lower bound with a view to avoid below-target inflation becoming entrenched and undermining the outlook for price stability. The inflation surge experience prompted the Governing Council to acknowledge in the 2025 strategy assessment that forceful or persistent action is needed in the event persistent deviations from the target – whether on the upside or on the downside – and that there is a temporal dimension in the choice between forcefulness and persistence.

The issues at stake are distinct for downside and upside deviations from target though. As already emphasized when concluding the 2021 strategy review, for large disinflationary shocks, forceful or persistent action may help to address the constraint imposed by the effective lower bound on nominal interest rates, providing the required monetary stimulus and avoiding below-target inflation becoming entrenched. When facing the prospect of hitting the effective lower bound, decisive early action on interest rates is also likely to be more effective than announcing potentially less credible rate paths far into the future. Persistence can contribute to overcoming the effective lower bound, rather than an unconditional promise to keep rates permanently low.

The recent inflation surge demonstrated that appropriately forceful or persistent monetary policy action is also warranted in response to large, sustained upside deviations of inflation from the target. Forceful action in the initial tightening phase can help counter the risk of an upside de-anchoring of inflation expectations and mitigate second-round effects as well as possible non-linearities in price and wage setting. Accordingly, the monetary policy tightening was forceful in the early phase of the hiking cycle, with the Governing Council raising the deposit facility rate from -0.5 per cent to 3 per cent between July 2022 and March 2023.

Since the risks and side effects (for economic activity and financial stability, for instance) associated with monetary policy tightening increase as interest rates rise further or faster into restrictive territory, shifting the focus from forcefulness to persistence as the tightening cycle proceeds can be optimal. Hence, later in the rate hiking cycle the Governing Council’s attention shifted from forcefulness to persistence, opting for smaller rate increases and emphasizing that the key ECB interest rates would be set at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to the medium-term target.

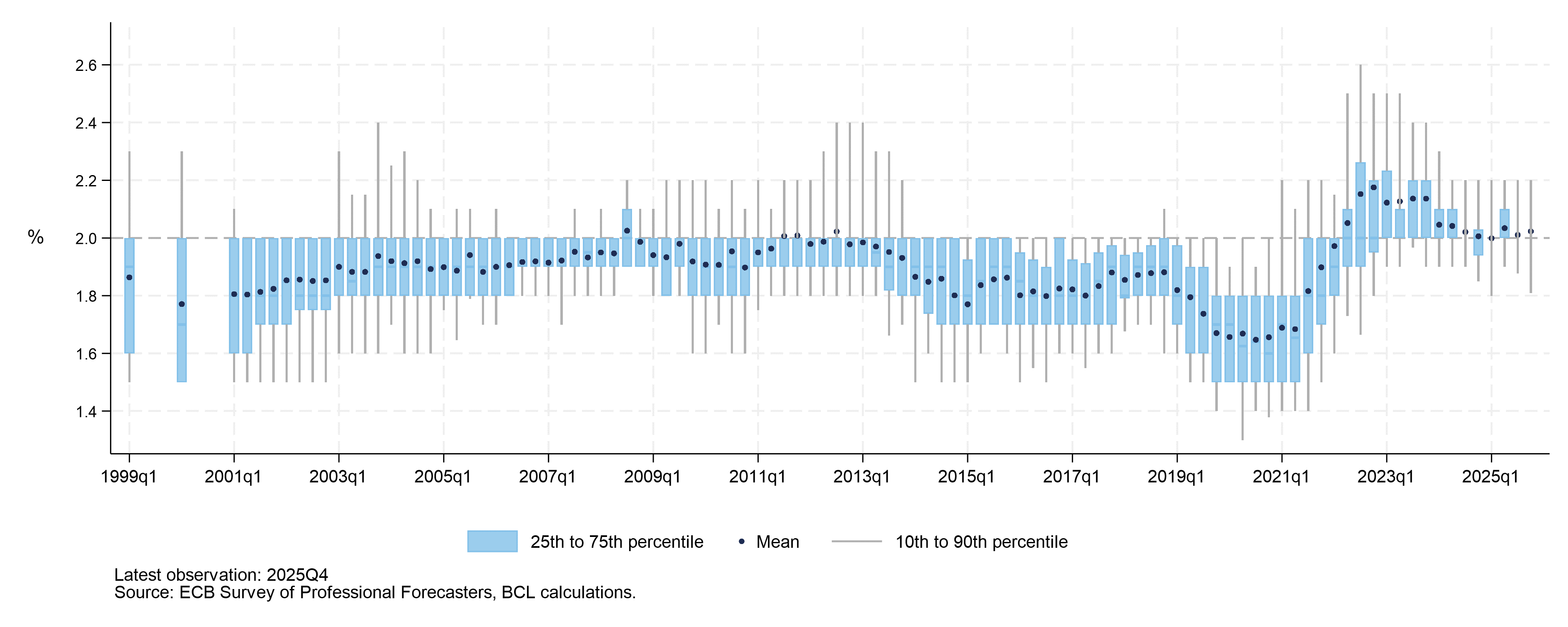

Overall, by virtue of its strong anchoring properties, the unambiguous inflation target smoothed the absorption of the inflation surge while avoiding excessive second-round effects and undue employment fallout. Together with the initially forceful and then persistent monetary policy response the unambiguous symmetric inflation target helped to contain risks of upside de-anchoring, providing a clear anchor for longer-term inflation expectations, which is essential for maintaining price stability. Most survey-based and market-based measures pointed to longer-term inflation expectations remaining anchored at 2 per cent during the inflation surge (as documented by the relatively stable level of longer-term inflation expectations of professional forecasters and their very limited dispersion in Graph 2 below).

Graph 2: Inflation expectations by professional forecasters (4-5 years ahead)

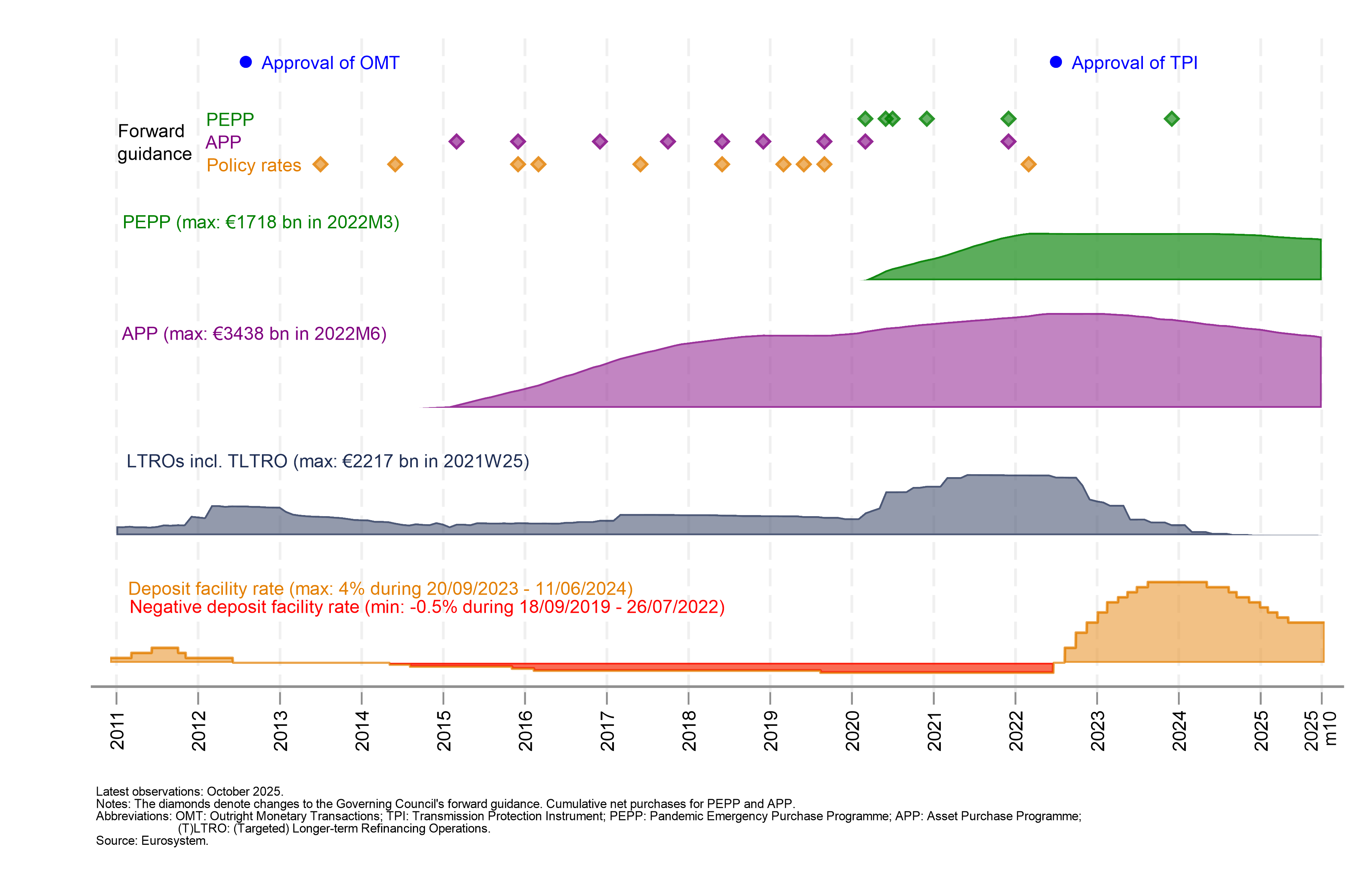

The Eurosystem monetary policy toolkit

In the 2021 strategy review, the Governing Council confirmed unconventional monetary policy tools as an integral part of the monetary policy toolkit. In reaction to the global financial crisis and facing major disinflationary factors and shocks and less space available for monetary easing by conventional interest rate policy, the Governing Council made recourse to a number of unconventional monetary policy tools (Graph 3).

Graph 3: Comprehensive and flexible use of key Eurosystem instruments

As part of the 2025 strategy assessment, the Governing Council reviewed the effectiveness as well as the side effects of its tools based on the experience made since 2021 and concluded:

- overall, the set of instruments has proven effective in countering disinflationary risks and/or safeguarding risks to the transmission of the policy stance, and they should all remain part of the toolkit;

- deploying a mix of instruments (potentially reinforcing each other) near the effective lower bound, instead of an excessively intensive use of single instruments (potentially suffering from lower effectiveness and stronger side effects), is advisable;

- there is a trade-off between commitment (desirable to counter one-sided deflationary risks at the effective lower bound) and flexibility (necessary if the inflation environment changes promptly). Unconditional time-based guidance on asset purchases over a pre-determined and extended horizon may interfere with state-based rate forward guidance (if coupled with a sequencing commitment whereby purchases end before rates can be raised), thereby reducing policy flexibility to respond to inflationary shocks in an agile way. The choice, design and implementation of instruments needs to recognise the constantly evolving financial and macroeconomic conditions and enable an agile response to new shocks;

- the establishment and/or deployment of new tools (like the Transmission Protection Instrument)[7] or adjustments of existing tools (like TLTRO III and PEPP) demonstrate that the ECB’s toolkit is adaptable also in the face of new challenges. The Governing Council will continue to respond flexibly to new challenges as they arise and will consider, as needed, new policy instruments in the pursuit of its price stability objective;

- the primary monetary policy instrument is the set of ECB policy rates, with the monetary policy stance currently being steered through the deposit facility rate. The Governing Council may also employ other instruments, as appropriate, to steer the monetary policy stance when the policy rates are close to the lower bound or to preserve the smooth functioning of monetary policy transmission;

- while broadly contained so far, side effects on central bank profitability turned out to be more severe than expected in 2021 (though not threatening the Eurosystem’s ability to maintain price stability). The Governing Council will continuously monitor side effects and continue performing a comprehensive proportionality analysis when deploying or adjusting monetary policy instruments, with a view to minimising their side effects - including along the (projected) central bank income dimension - without compromising price stability.

[1] I would like to thank Patrick Lünnemann and Ladislav Wintr for support in preparing this article.

[2] The ECB’s mandate is conferred on it by the Treaty on European Union (TEU) and the Treaty on the Functioning of the European Union (TFEU). The primary objective of the ECB is to maintain price stability in the euro area. Without prejudice to the price stability objective, the Eurosystem (i.e. the ECB and euro area national central banks) shall support the general economic policies in the EU with a view to contributing to the achievement of the Union’s objectives as laid down in Article 3 of the TEU. Similar to the strategy reviews conducted in 2003 and in 2021, the 2025 strategy assessment took the ECB’s mandate as given.

[3] Between January 2015 and December 2020, year-on-year headline inflation averaged 0.9 per cent.

[4] Also in line with recent expert recommendations to give less prominence to the central (or “baseline”) forecast and place more weight on scenario and risk analysis, see e.g. B. Bernanke (2024) “Forecasting for monetary policy making and communication at the Bank of England: a review,” Bank of England, published on 12 April 2024.

[5] In 1998 the Governing Council had defined price stability as a year-on-year increase in the Harmonised Index of Consumer Prices for the euro area of below 2 per cent over the medium term. The definition made it clear that inflation above 2 per cent was not consistent with price stability – the primary objective of the ECB. It also implied that very low inflation rates, and especially deflation, were not consistent with price stability either. In 2003, in the context of its first evaluation of the monetary policy strategy, the Governing Council confirmed the quantitative definition of price stability and clarified that, in pursuing price stability, it will aim to keep the euro area inflation rate at below, but close to, 2 per cent over the medium term (“double-key formulation”).

[6] Model simulations suggest targeting an inflation rate of 2 per cent contributes to stabilising inflation at target over the longer run, limiting inflation volatility and the frequency of hitting the lower bound while mitigating the welfare costs of higher inflation. Given the range of conventional and unconventional monetary policy measures available, an inflation target of 2 per cent provides a sufficient inflation buffer, facilitating the smooth adjustment to macroeconomic imbalances and sectoral shocks also in the presence of downward nominal rigidities and considering one cannot exclude the HICP to slightly overstate the “true” rate of inflation.

[7] The Governing Council approved the Transmission Protection Instrument (TPI) in July 2022. As announced in the dedicated ECB press release of 21 July 2022, “the Governing Council assessed that the TPI is necessary to support the effective transmission of monetary policy. […] The TPI […] can be activated to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across the euro area. […] Subject to fulfilling established criteria, the Eurosystem will be able to make secondary market purchases of securities issued in jurisdictions experiencing a deterioration in financing conditions not warranted by country-specific fundamentals, to counter risks to the transmission mechanism to the extent necessary. The scale of TPI purchases would depend on the severity of the risks facing monetary policy transmission. Purchases are not restricted ex ante. […] A decision by the Governing Council to activate the TPI will be based on a comprehensive assessment of market and transmission indicators, an evaluation of the eligibility criteria and a judgement that the activation of purchases under the TPI is proportionate to the achievement of the ECB’s primary objective. […] The Governing Council will consider a cumulative list of criteria to assess whether the jurisdictions in which the Eurosystem may conduct purchases under the TPI pursue sound and sustainable fiscal and macroeconomic policies. […] Purchases under the TPI would be conducted such that they cause no persistent impact on the overall Eurosystem balance sheet and hence on the monetary policy stance.” Although the TPI has not been activated to date, its announcement contributed to the smooth transmission during the normalisation and the tightening of monetary policy prompted by the 2021-2023 inflation surge.